Your cart is currently empty!

Get top mortgage servicers monthly volumes

Agency MSR transfers, aggregation and originations have reshaped the top mortgage servicers list.

Some mortgage technology and service providers are still working with data that is years old, relying on their personal network, and attending conferences to meet the same customers.

If you are looking for a repeatable data-driven approach to grow your business.

Top mortgage servicers by financial institution type

Shows unit loan volume by banks, credit unions, and non-banks

Top mortgage servicers by property type

Shows unit loan volume by 1-4 family, condo, co-op, manufactured and PUD

Top mortgage servicers by

agency

Shows unit loan volume by Freddie Mac, Fannie Mae and Ginnie Mae

Top mortgage servicers by

pool type

Shows unit loan volume by TBA, HML-LB, Geo, Jumbo, Seconds, FICO and HLTV

Top mortgage servicers by production channel

Shows unit loan volume by retail, correspondent and wholesale broker

Top mortgage servicers by valuation method

Shows unit loan volume by appraisal, waiver and waiver + property inspection

Top mortgage servicers for jumbo loans

Shows unit loan volume for jumbo loans and can be combined with other factors

Top mortgage servicers by

State

Shows unit loan volume by State and can be combined with other factors

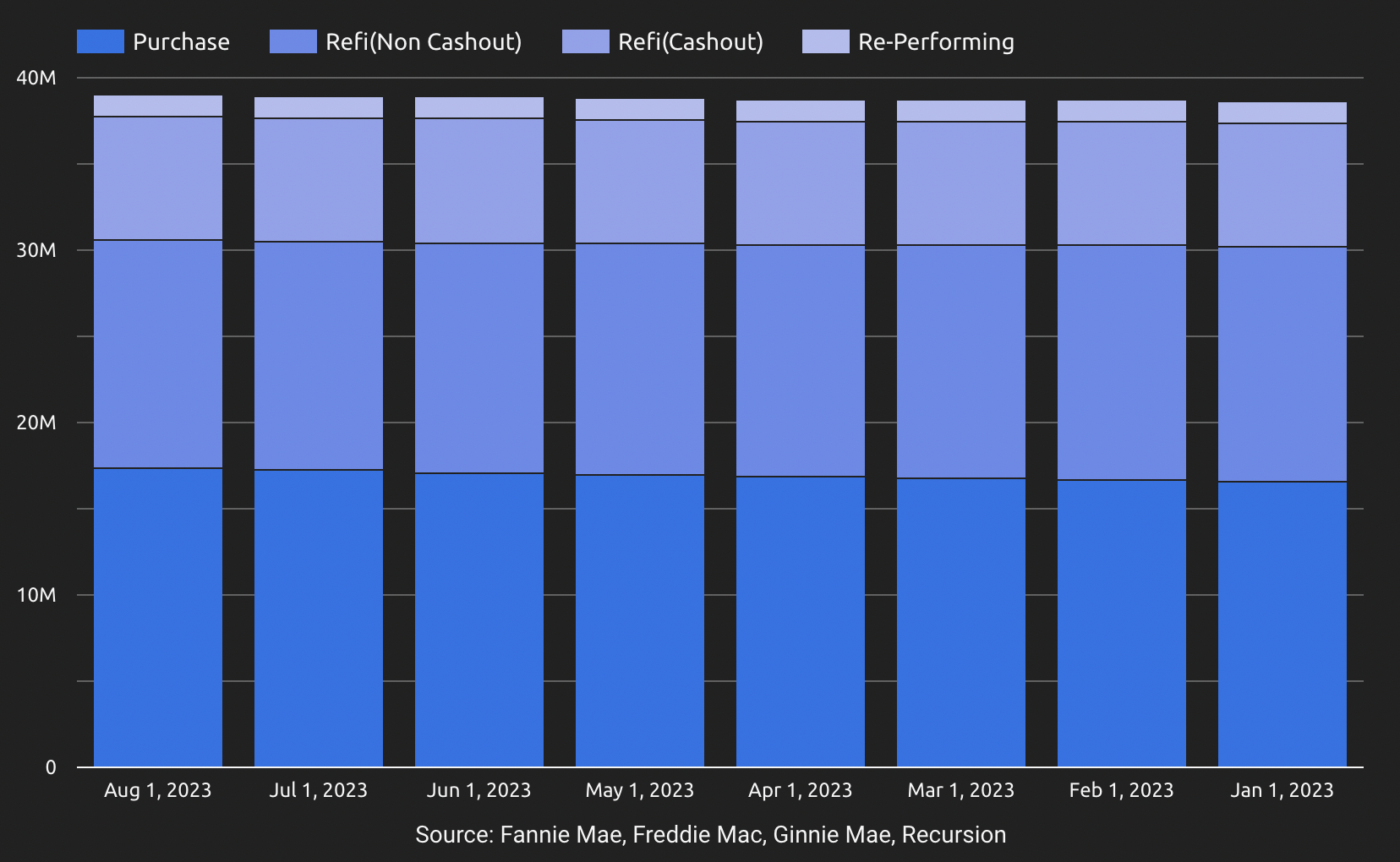

Top mortgage servicers by loan purpose

Shows unit loan volume by re-performing purchase, cash out & no cash out refi

Top mortgage servicers by special loan program

Shows unit loan volume by HomeReady, HomePossible, RefiNow & RefiPossible

Top mortgage servicers for ARM loans

Shows unit loan volume for ARM loans and can be combined with other factors

Top mortgage servicers for first-time buyers

Shows unit loan volume for first-time buyers; combined with other factors

Top mortgage servicers by MSR transfers

Shows unit loan volume transferred to/from the top servicers

Top mortgage servicers with mortgage insurance

Shows unit loan volume for MI loans and can be combined with other factorss

Top mortgage servicers by custom factors

Shows unit loan volume by customer requested factors

518

Active bank

agency servicers in August 2023

275

Active credit union

agency servicers in August 2023

317

Active non-bank

agency servicers in August 2023

1,121

Active agency

servicers in

August 2023

Frequently Asked Questions

Where are the sources of top mortgage servicers data?

Data is sourced from multiple and different industry approved datasets, validated and reconciled. As Fannie Mae notes in their research, “…there is no universal source for market-wide mortgage originations data.”

Can we purchase one-time?

Yes, data can be purchased at a specific point in time.

Can we upgrade from one-time to a subscription?

Yes, upgrades made within two months of initial purchase qualify for subscriptions pricing.

Can we get a subscription?

Yes, annual subscriptions can be purchased, with scheduled product deliveries.

Can we get sample of a top mortgage servicers report?

Yes, we provide limited samples of historic data for review.

How often is the top mortgage servicers report available?

Servicing data is available monthly; ready for delivery on the seventh day after month end.

What are the payment options?

We support credit card and ACH payment methods.

Take the next step to grow your business

Find out more about the top mortgage servicers

“Invaluable insight into mortgage volumes and market dynamics…”

We evaluate a lot of mortgage technology and services businesses. This allows us to quickly run customer- level models to decide if and how we should proceed.

— Partner, Private Equity

“Champion challenger performance calls got easier…”

Before we start the monthly call we know the upside opportunity and downside risk associated with performance. We can request pipeline in areas we know we can perform; it’s a win-win.

— SVP Operations, Title & Valuations

“Understanding portfolio size and recapture rates is essential…”

Our transactions are based on overall portfolio size, agency mix and frequency of mark-to-model valuations. This data has changed the way we understand our sales pipeline.

— National Sales, Data & Analytics

“We track progress on appraisal (modernization) initiatives…”

We report monthly on these new waiver and hybrid programs to our production executives. We want to offer our LOs and borrowers the most innovative and cost effective choices we can.

— Collateral Policy, Top 20 Lender

“The top lender rankings have completely changed in 2023…”

This takes the guesswork out of sales. We know which lenders to target, and can see who is gaining or losing originations volume – big lenders have dropped significantly in the rankings.

— CEO, Mortgage Data & Analytics

“We are scrutinizing every marketing dollar we spend..”

We use the insights to update the originations market segmentation every month – we use it to evaluate content, conferences, and advertising – we invest where we can forecast a realistic ROI.

— CMO, Mortgage Settlement Software