Your cart is currently empty!

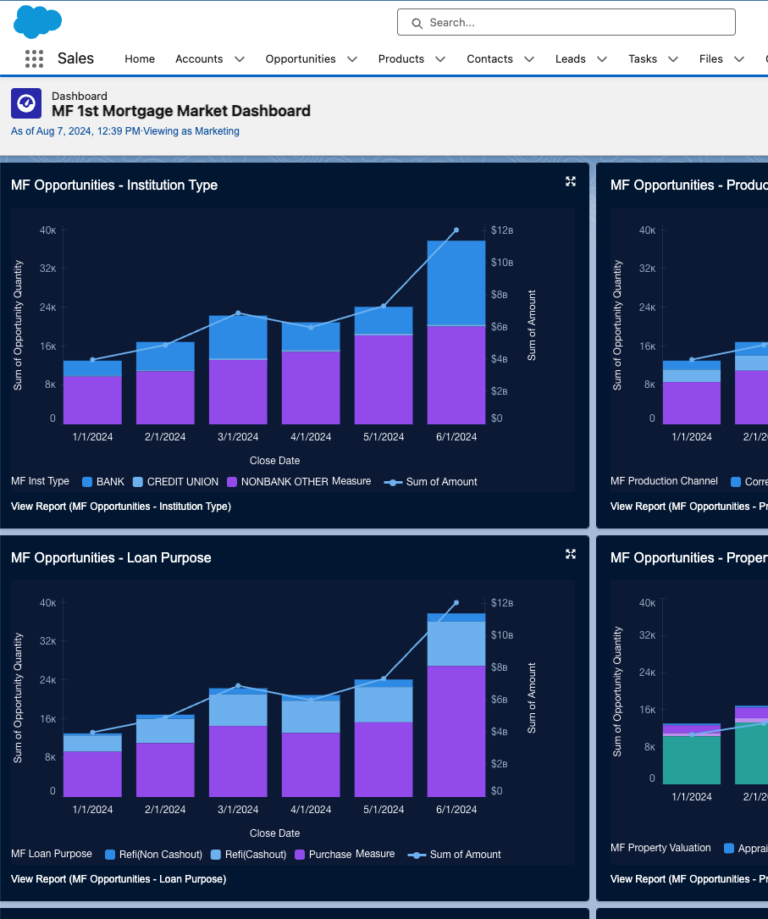

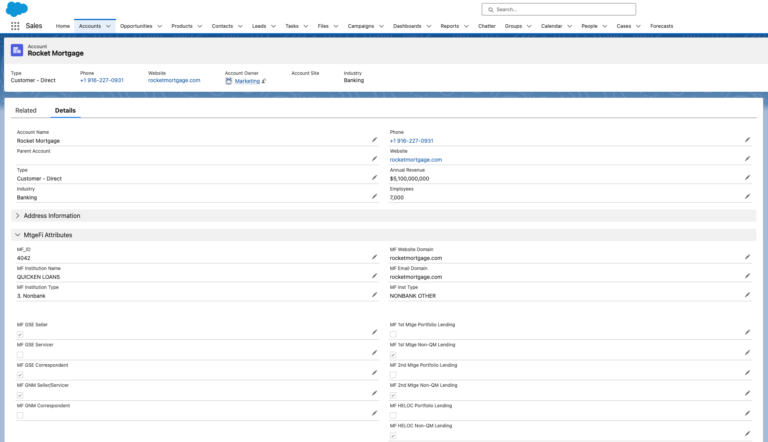

Salesforce mortgage data solution

Immediate access to trends, performance & data

A Salesforce mortgage solution that enables finance, product, marketing & sales to execute data-driven strategies to grow revenues and expand market share.

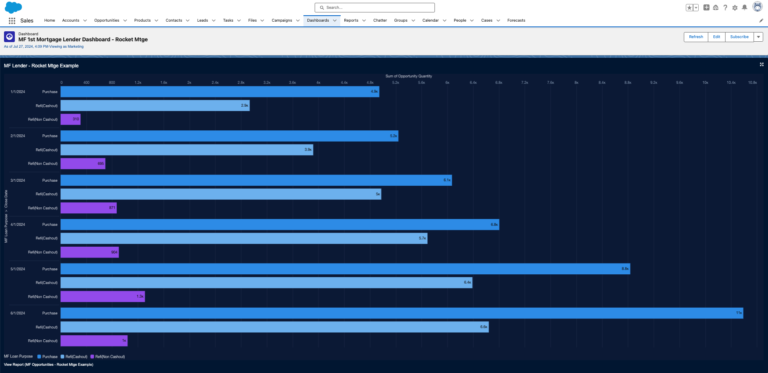

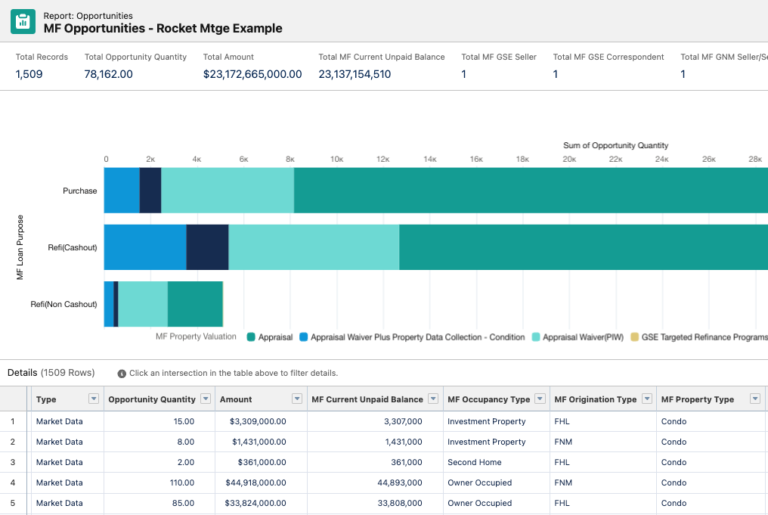

Provide visibility of loan & settlement services volume and market share, down to the individual lender level, directly from your Salesforce mortgage environment.

If you are looking for a repeatable data-driven approach to grow your business.

Salesforce mortgage package

The Salesforce mortgage package creates all the fields & reports to instantly upload data and track performance.

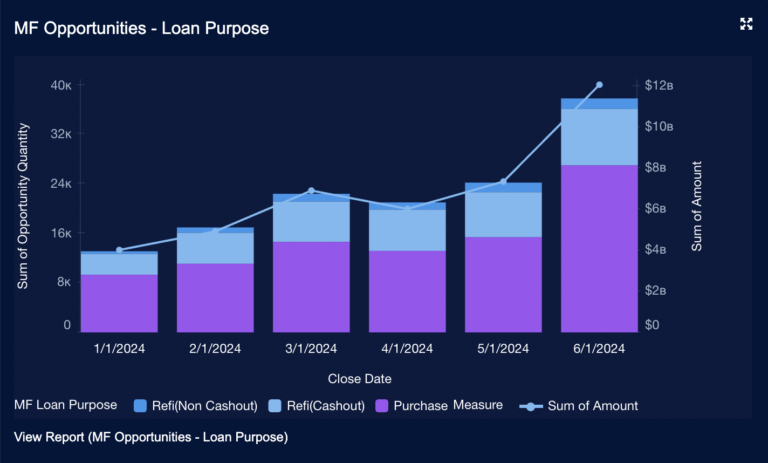

Track volumes at industry, market segment & institution-level

The Salesforce mortgage package allows you to track all aspects of mortgage and home equity lending.

Loan-level attribute analysis

The Salesforce mortgage package can track detailed loan level attributes, by lender and market segment.

Simplified data management

The Salesforce mortgage package introduces simple and easy-to-understand data standards that can easily be maintained.

2,528

Nonbank lenders for 1st & 2nd mortgage & HELOCS

4,578

Bank lenders for 1st & 2nd mortgages and HELOCS

3,192

Credit union for 1st & 2nd mortgages and HELOCS

5,480

Active agency correspondent sellers

1,861

Active GSE agency seller/servicers

Frequently Asked Questions

Is this a Salesforce managed package, or available via AppExchange?

No, this is an unmanaged package that is accessed via a private URL and password, and not available via AppExchange.

How many components are in this Salesforce managed package?

A total of 66 components, including 25 Account, 2 Contact, 2 Lead and 11 Opportunity fields, plus 12 Global Value Sets, 10 Reports and 3 Dashboards.

Can the package components be customizable and/or removed?

Yes, because this is a Salesforce unmanaged package all the components can be edited or deleted.

Can we request additional components or a private unmanaged package?

Yes, MtgeFi will incorporate additional components if generally applicable, or create a bespoke customer package.

Can we get a subscription?

Yes, annual subscriptions can be purchased, with scheduled product deliveries monthly.

Can we get sample of data?

Yes, we provide limited samples of historic data for review.

What if we use Hubspot?

Hubspot does not have similar package management functionality, but we license the Company, Deal and Contact custom property definitions to customers.

How often is the data refreshed?

Agency originations data is available monthly; ready for delivery on the seventh business day after month end. Non-agency data is refreshed quarterly.

What are the payment options?

We support credit card and ACH payment methods.

Take the next step to grow your business

Find out how to monitor your market share and forecast revenue growth

“Invaluable insight into mortgage volumes and market dynamics…”

We evaluate a lot of mortgage technology and services businesses. This allows us to quickly run customer- level models to decide if and how we should proceed.

— Partner, Private Equity

“We can plan for monthly lender performance calls…”

Before we start the monthly call we know the upside opportunity and downside risk associated with performance. We can request pipeline in areas we know we can perform; it’s a win-win.

— SVP Operations, Title & Valuations

“We know what unit volume commitments we should ask for…”

When on-boarding new lenders we are asked to implement one-off processes on promises of volume. This knowledge allows us to secure a volume ramp based on hitting agreed milestones.

— EVP Sales, Large National AMC

“We track progress on appraisal (modernization) initiatives…”

We report monthly on these new waiver and hybrid programs to our production executives. We want to offer our LOs and borrowers the most innovative and cost effective choices we can.

— Collateral Policy, Top 20 Lender

“The top lender rankings have completely changed in 2023…”

This takes the guesswork out of sales. We know which lenders to target, and can see who is gaining or losing originations volume – big lenders have dropped significantly in the rankings.

— CEO, Mortgage Data & Analytics

“We are scrutinizing every marketing dollar we spend..”

We use the insights to update the originations market segmentation every month – we use it to evaluate content, conferences, and advertising – we invest where we can forecast a realistic ROI.

— CMO, Mortgage Settlement Software