Your cart is currently empty!

The adoption and use of inspection based waivers at nonbank retail lenders has increased steadily in the last 12 months. This article provides a review and benchmark of the average and top lender use of inspection based waivers for nonbank retail lenders.

Eligibility estimate approach

A note on the methodology used and information presented on appraisal waiver and inspection based waivers at nonbank retail lenders:

- The goal is to assess overall lender adoption and utilization of the waiver solutions

- We determine ‘total eligibility’ from the GSE published eligibility requirements (‘credit box’) as this changes infrequently, and provides a baseline of comparison

- The actual number of appraisal waivers and inspection based waivers offered via GSE automated underwriting systems will be significantly lower, and based on the specific loan characteristics; some lenders will not see few, if any, offers

- The GSEs do not publish separate eligibility criteria for appraisal waivers (AWs) and inspection based waivers (IBWs) – there is a single credit box for AWs and IBWs

- The GSE have similar eligibility requirements, but there are notable differences

- The unit volumes are based on GSE issuance in Q2 2024

New Information about Inspection Based Waivers

Learn how lenders and borrowers are benefitting from inspection based waivers and the top 10+ reasons to adopt now

Inspection based waivers at nonbank retail – eligibility

The eligibility estimates show, as expected, that non cashout refinances have the largest credit box (83%), with overall eligibility across purchase and refinance at 53%.

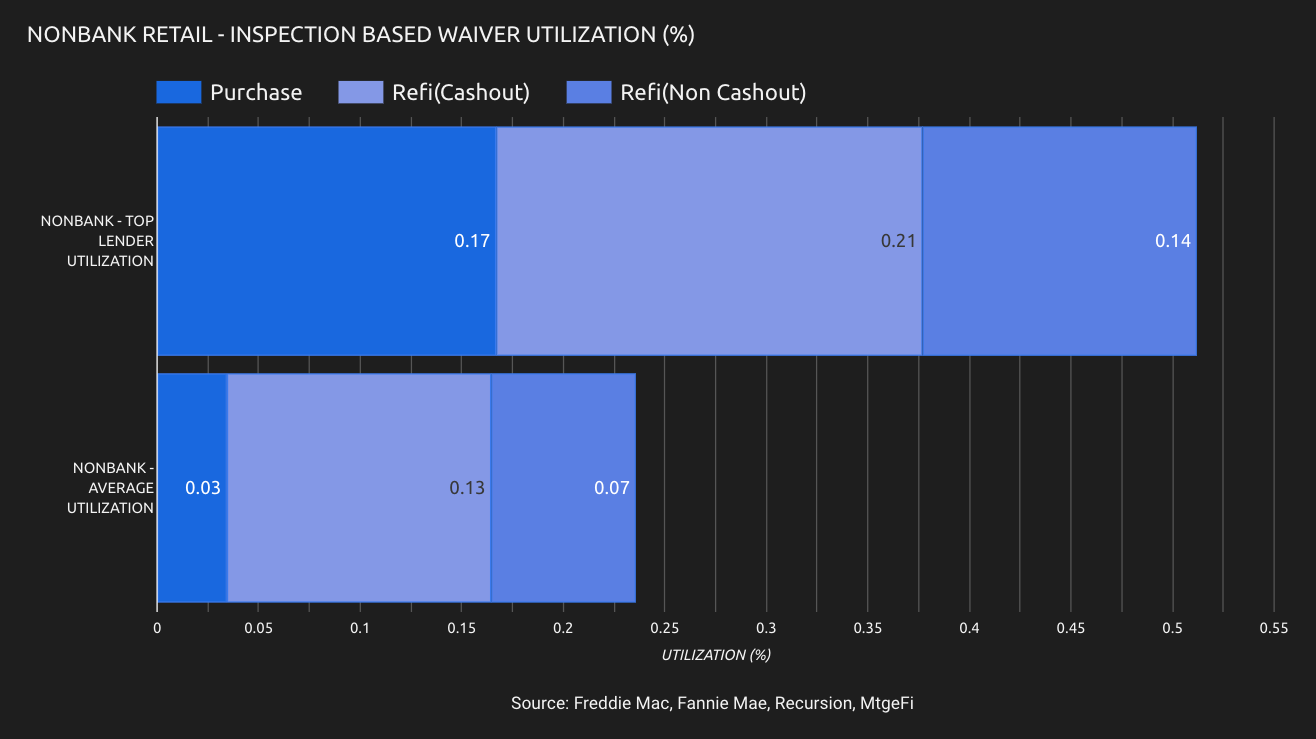

Nonbank retail – average vs top lender utilization

Of the 95,446 loans in the credit box GSE sellers delivered 30,590 (32%) using an appraisal waiver or inspection based waiver.

Average lender utilization – industry benchmark

For nonbank retail, the average utilization for appraisal waivers was 26% and for inspection based waivers was 6%.

Top lender utilization – benchmark

For nonbank retail lenders who delivered a minimum of 100 loans in the quarter, top performing lenders utilization is significantly higher. Most notably, with an average of 19% utilization for purchase and refinance, use of inspection based waivers is over 300% when compared to the average lender. This provides a useful benchmark for lenders to evaluate their adoption of these solutions.

Utilization of appraisal waivers for top lenders was 37%, over 42% higher than the industry average of 26%, and nearly 50% higher for purchase transactions.

Number of lenders adopting solutions

In Q2 2024, a total of 120 nonbank retail lenders delivered loans using inspection based waivers out of a total of 420 GSE sellers for the quarter. Of these, 113 used Freddie Mac solutions, representing 37.9% of the 298 active sellers. For Fannie Mae, 53 delivered loans using inspection based waivers out of 370 (14.3%) active sellers.

More information about inspection based waivers at nonbank retail lenders

For lenders who wish to learn more, you can check out the the following articles. These include links to the Freddie Mac ACE+ PDR and Fannie Mae Valuation Acceptance and collateral valuation modernization strategies, new programs, selling guide updates, FAQs, process flow, job aids, approved technology and service providers, and information about the property data standards and user guides:

- Implementing the Freddie Mac Inspection-based Waivers – Quick Reference for Lenders

- Implementing the Fannie Mae Inspection-based Waivers – Quick Reference for Lenders

In addition, you can access the Freddie Mac ACE+ PDR Solution page and the Fannie Mae Value Acceptance + Property Data FAQ.