Your cart is currently empty!

For May 2025, GSE issuance totaled $56.7BN, up 19.4% on April, and up 1.8% on May 2024. For property valuations, $46.3BN (81.6%) closed using appraisals, up 18.6%, and $9.08BN (16.0%) closed utilizing appraisal waivers, up 22.4% on the prior month.

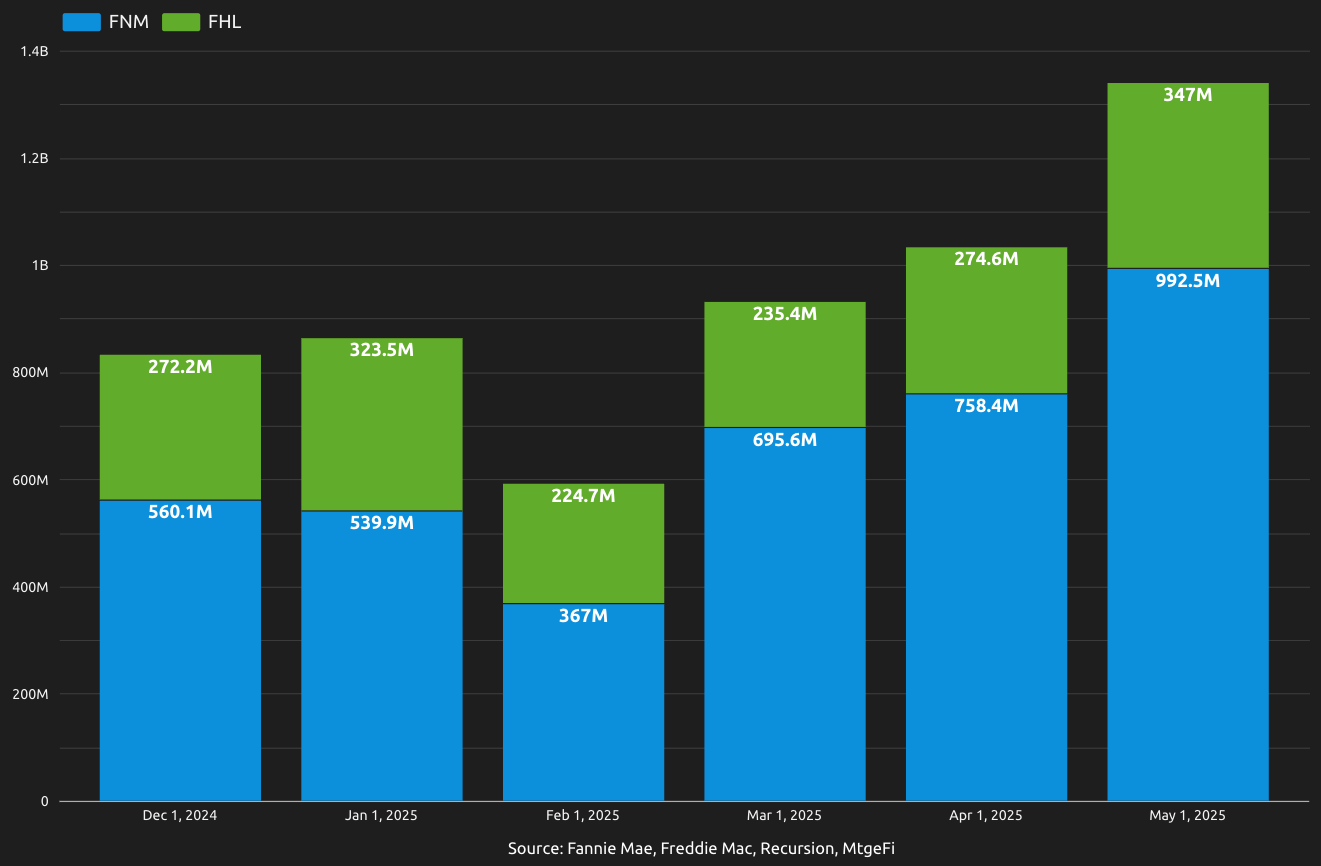

Lenders delivered $1.34BN (2.36%) with inspection based appraisal waivers in May, up 29.7% on April. This is the highest month on record, the 3rd month to have surpassed 2% of loan balance issued, and the 4th month where issuance have exceeded $1BN since the GSE programs started. By loan count inspection based appraisal waivers were 2.95% of issuance.

Overall, inspection based waivers in May were 12.9% of the combined non-appraisal solutions by loan balance. By number of loans delivered, inspection-based waivers were 14.8% of all waiver solutions.

Combined use of inspection based waivers and appraisal waivers in May was 18.4% by balance and 19.9% by loan count.

Agency share of appraisal waivers in May

Fannie Mae Valuation Acceptance + Property Data market share of inspection based waivers in May was up marginally to 74.1% on volume of $992MM, up 30.9% on April. There are 409 lenders who have delivered loans through Fannie Mae Valuation Acceptance + Property Data, including 221 independent mortgage companies and 115 banks and 74 credit unions. A total of 82 lenders issued loans using inspection based appraisal waivers in May with Valuation Acceptance + Property Data, down 1.2% on April.

Freddie Mac ACE+ PDR (Automated Collateral Evaluation plus Property Data Report) market share for inspection based waivers in May was 25.9% on volume of $347MM, up 26.4%. Freddie Mac participation is at 472 lenders, including 184 banks, 42 credit unions, and 246 non-banks. A total of 117 individual lenders issued loans using inspection based waivers with ACE+ PDR, up 7.3% on the prior month.

Bank, credit union & nonbank using appraisal alternatives

For bank sellers, 69.5% have used appraisal waivers and 25.7% have used inspection based waivers to deliver loans to the GSEs in the past couple of years. In May 43.4% used appraisal waivers and 7.9% used inspection based waivers.

For credit union sellers, 73.5% have used appraisal waivers and 24.7% have used inspection based waivers to deliver loans to the GSEs, again since 2023. In May 46.9% used appraisal waivers and 7.6% used inspection based waivers.

For nonbank sellers, 79.5% have used appraisal waivers and 46.1% have used inspection based waivers to deliver loans to the GSEs. In May 72.8% used appraisal waivers and 21.1% used inspection based appraisal waivers.

GSE Appraisal Modernization Lenders – 2017 to Q1 2025

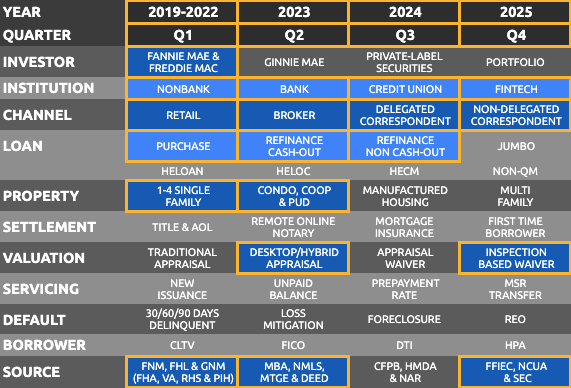

This report identifies lenders utilizing GSE appraisal modernization solutions from 2017 through Q1 2025. This allows users to assess which lenders have already utilized inspection-based appraisal waivers, and are able to take advantage of hybrid appraisals immediately, and lists 585 GSE direct sellers and 2070 GSE correspondents.

Production channel

Broker channel issuance was $10.6BN in May with 121 lenders delivering loans, up 18.5% on last month. Correspondent channel issuance was $19.9BN from 172 lenders, up 16.7%. Retail issuance was $26.1BN from 1,187 lenders, up 21.9% on April.

For inspection based appraisal waivers in May, broker volume was $533MM and 39.8% of loans delivered, up 26.5% from 22 sellers. The correspondent channel was $163MM and 12.2%, up 3.5% of the overall volume from the prior month, from 26 aggregators. Retail channel utilization of inspection-based waivers was up 41.7% to $643MM at 48.0% of issuance from 131 lenders.

Top lender utilization of waivers

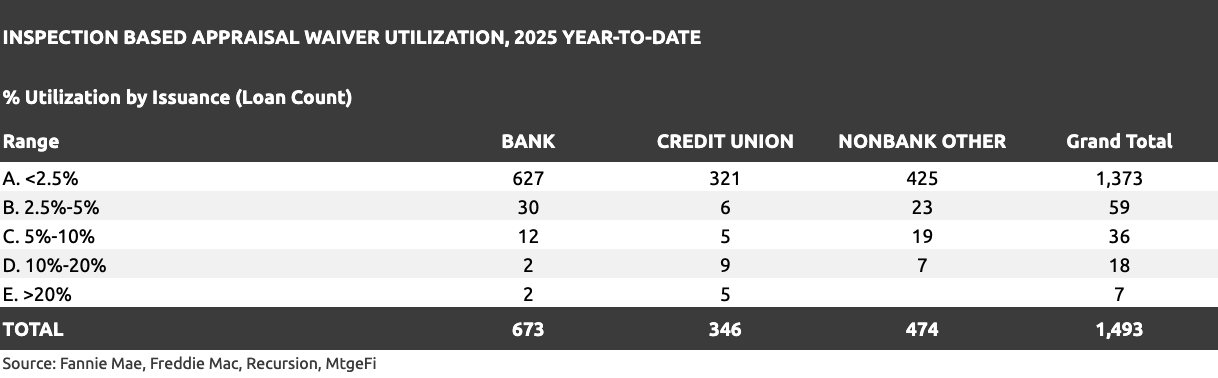

For 2025 year-to-date, the market-level utilization by loan count of appraisal waivers is 15.6% and for inspection based waivers 2.46%. Volume is heavily skewed to top banks and nonbank lenders who have optimized production for waivers. The table below shows that ~120 lenders have significantly higher utilization than peers, when compared to their overall loan production volume.

Hybrid appraisals, now live in the GSE selling guides, use the same on-site property inspection report, so expect to see the same lenders be early users of these new valuation solutions.

More about inspection based waivers in May

For lenders who wish to learn more, you can check out the following articles. These include links to the Freddie Mac ACE+ PDR and Fannie Mae Valuation Acceptance and collateral valuation modernization strategies, new programs, selling guide updates, FAQs, process flow, job aids, approved technology and service providers, and information about the property data standards and user guides:

- Implementing the Freddie Mac Inspection-based Waivers – Quick Reference for Lenders

- Implementing the Fannie Mae Inspection-based Waivers – Quick Reference for Lenders

In addition, you can access the Freddie Mac ACE+ PDR Solution page and the Fannie Mae Value Acceptance + Property Data FAQ.