Your cart is currently empty!

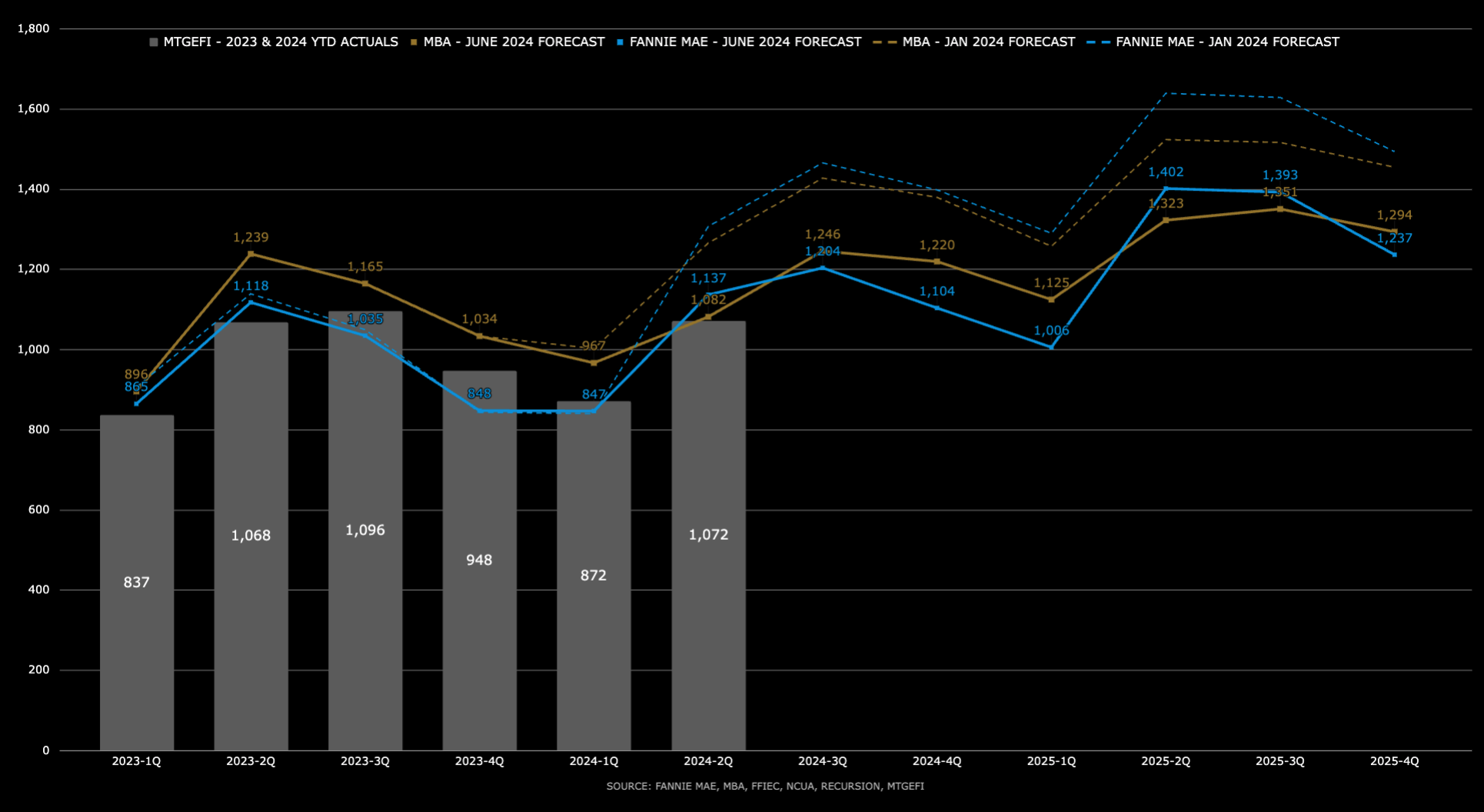

Fannie Mae and MBA published their latest housing finance forecast for June 2024 this week providing estimates of the quarterly purchase and refinance origination volumes for 1st lien, closed-end, single family mortgages in 2024 and 2025.

For June, the MBA and Fannie Mae forecasts for 2024 and 2024 remain aligned as both lowered purchase and refinance origination estimates slightly when compared to the projections published in May 2024. MBA origination volume is still projected at 4.9% higher for 2024 and 1.1% higher for 2025, when compared to Fannie Mae.

This article provides a brief review of these latest forecasts and highlights the major changes in projected loan originations, expressed in loan counts, compared to prior months, plus how the forecasts are tracking to the latest reported loan volume.

Fannie Mae and MBA housing forecast for June 2024

The MBA forecast now estimates 4,515,000 and 5,093,000 loan originations for 2024 and 2025 respectively. MBA lowered their 2024 and 2025 estimates by 0.6% and 0.2% respectively. Since January 2024, the MBA has lowered 2024 and 2025 estimates by 22.1% and 21.8% respectively.

The Fannie Mae forecast now estimates 4,292,000 and 5,038,000 loan originations for 2024 and 2025 respectively, down 1.0% and 0.5% on prior month estimates. Since January 2024, Fannie Mae has lowered 2024 and 2025 estimates by 34.7% and 38.6% respectively.

The table below shows how the housing finance forecasts have been updated monthly, and the current variance of MBA versus Fannie Mae. MBA and Fannie Mae have yet to update 2023 actuals after the release of HMDA 2023.

Housing finance forecast for June 2024 with latest origination volume actuals (‘000s)

MtgeFi produces a consolidated quarterly model with actual loan volumes to compare to the housing finance forecasts allowing customers to monitor budgets and track market share. For Q2 2024, we are reporting agency and portfolio originations of 1,072,000 1st lien, closed-end, 1-4 single family mortgages.

Data is available monthly or quarterly and include updates to MBA and Fannie Mae housing forecasts, current agency issuance and the latest bank and credit union portfolio originations.

Summary data available for free download

The summary data contained in the model is available for free download, and includes 2022 through 2023 actual loan volumes from agency issuance and bank & credit union portfolio originations. We are now reconciled to HMDA 2022 and HMDA 2023.

Housing Finance Forecast for June 2024

Consolidated housing finance forecast for June 2024 of first-lien closed-end 1-4 single family mortgage originations and purchases for 2022-2025, for agency issuance and bank & credit union portfolios, updated June 2024. Includes 2022 and 2023 actuals, MtgeFi projections, reconciliation to HMDA, and average loan amount from MBA.

More information about Fannie Mae and MBA economic and housing forecasts

To access the economic and housing finance forecasts from Fannie Mae and MBA archives directly: