Your cart is currently empty!

MtgeFi Blog

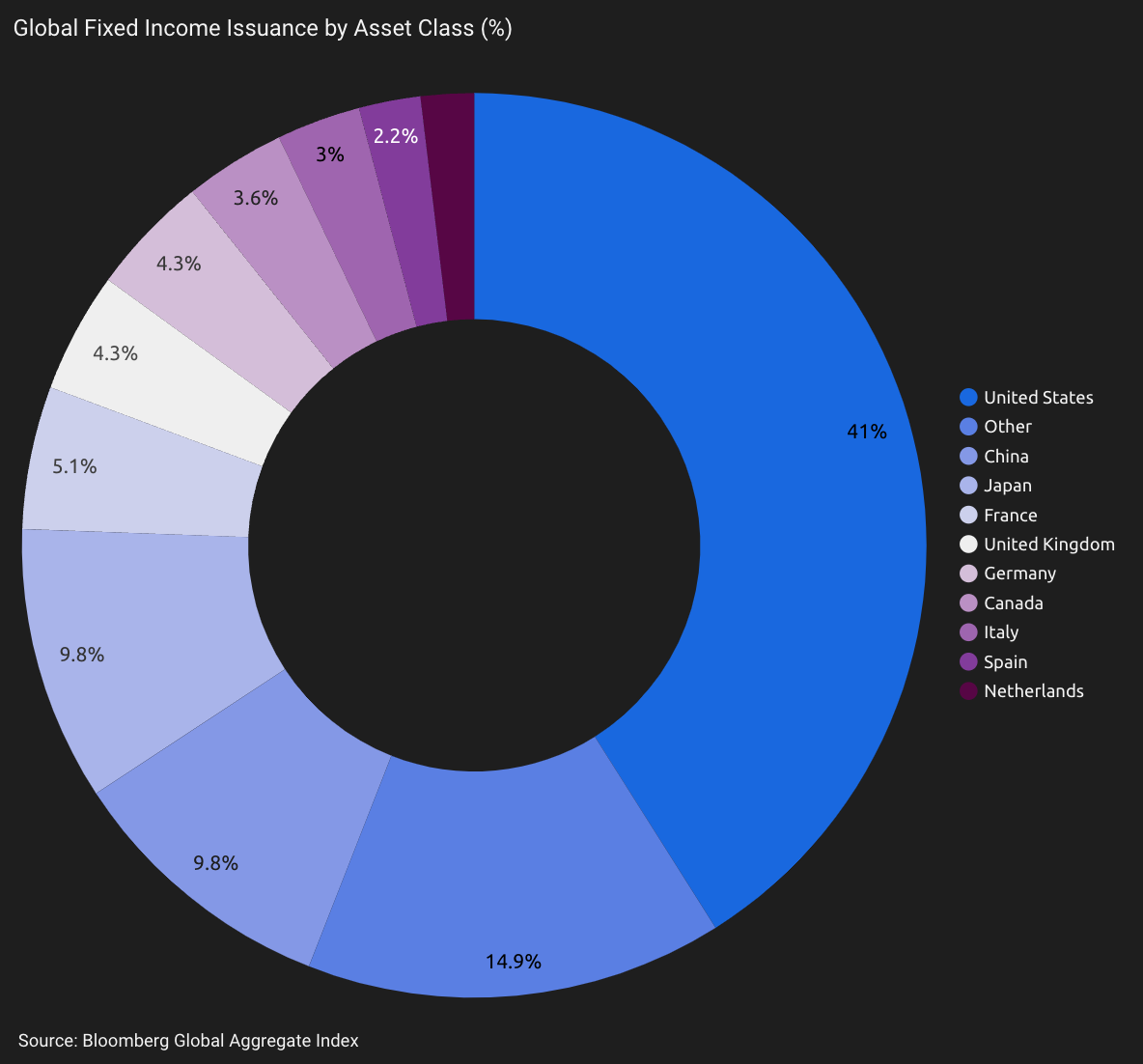

Top 10 reasons appraisals are here to stay, and critical to US and global markets

This article discusses the critical role of residential appraisals & appraisers in US housing finance and the global fixed income securities markets, and highlights the contributions appraisers make, and why they can be confident about the future of their profession.

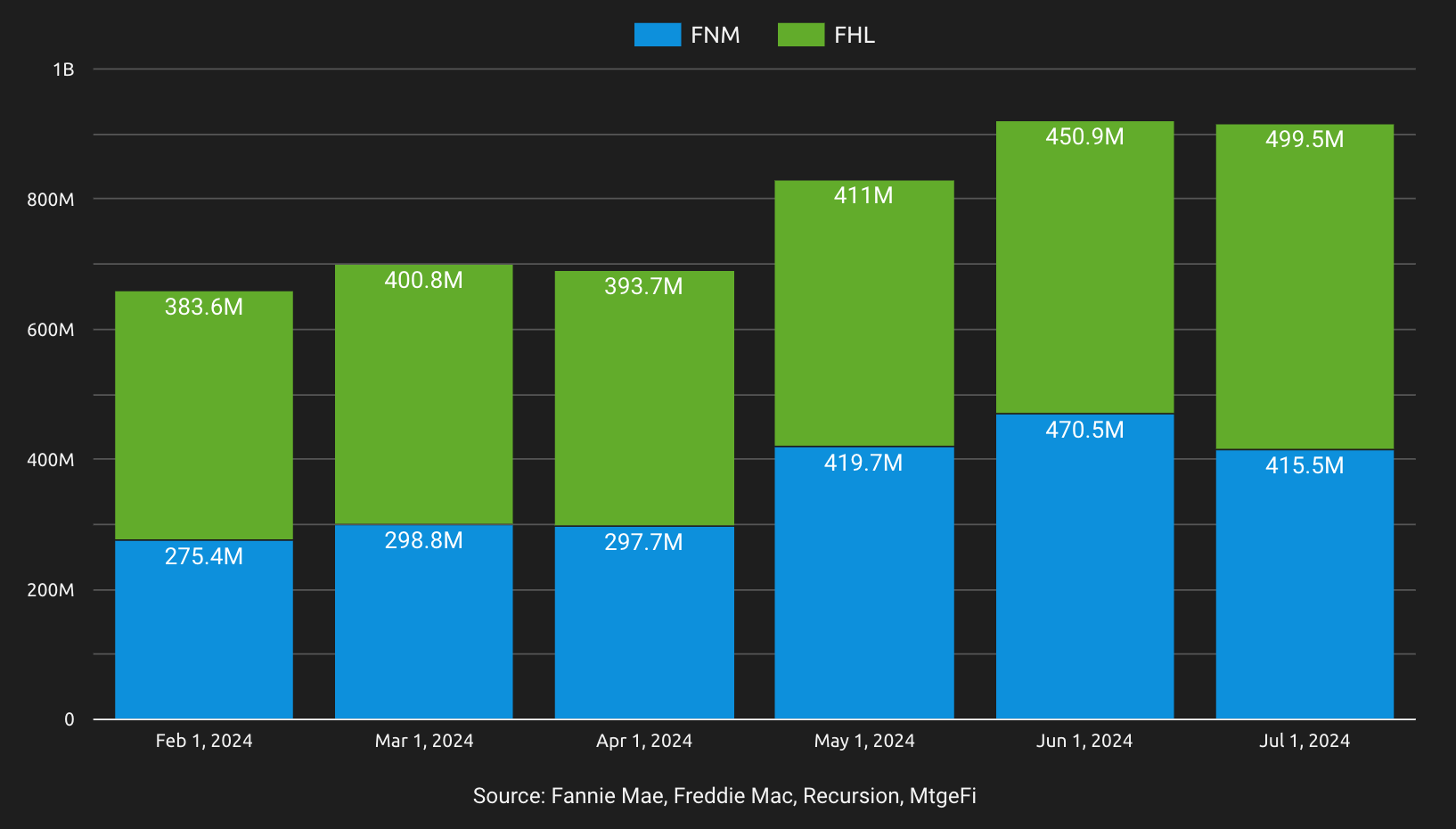

More than 1,000 correspondents now using inspection based waivers in July

Lenders delivered $915MM (1.56%) with inspection based waivers in July, down 2.3% on June 2024. A total of 1064 correspondents (excludes GSE sellers) have now exercised offers, compared to 547 direct GSE sellers.

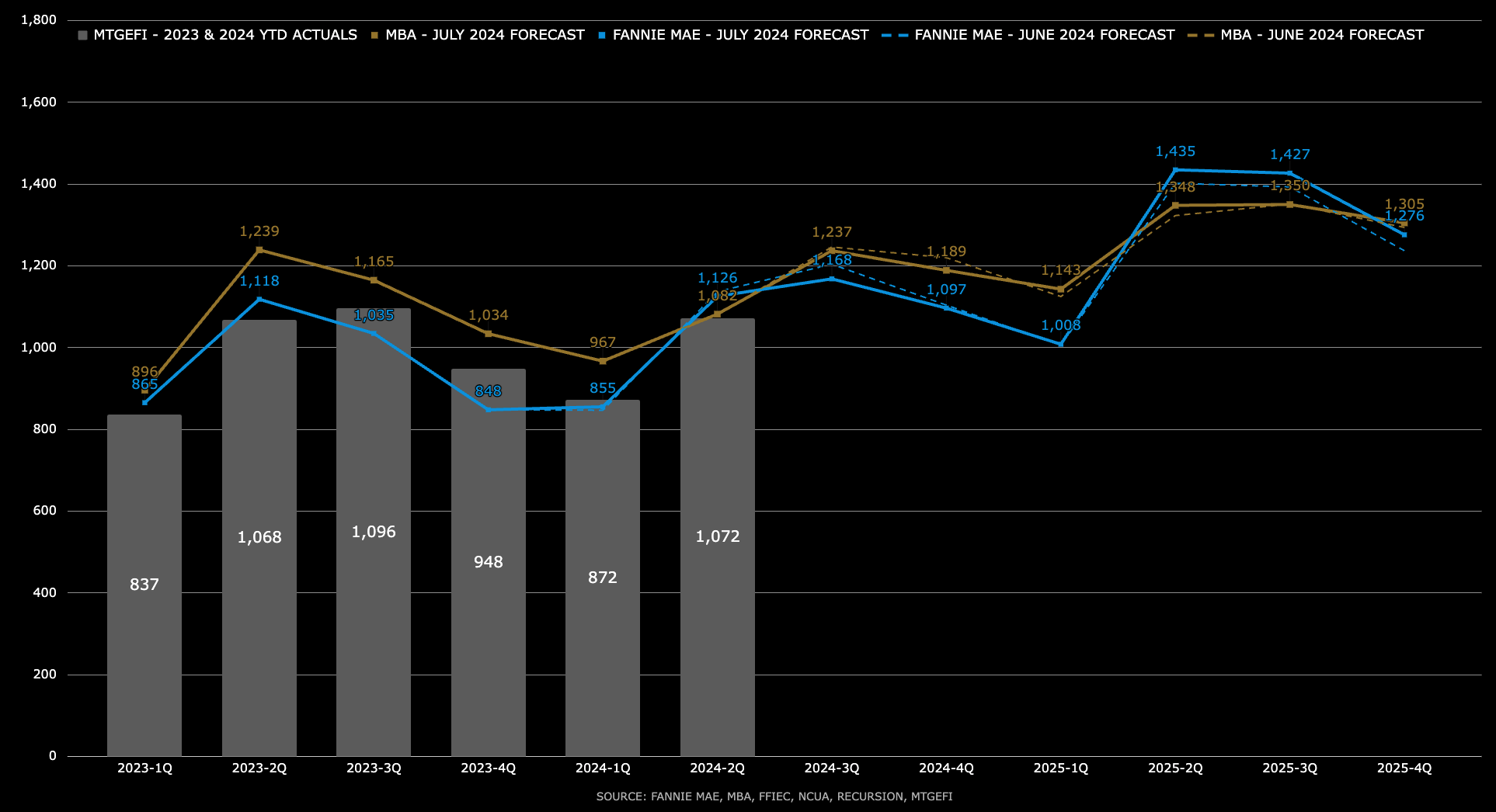

Housing Finance Forecast for July available now for 2024/2025

For July, the MBA and Fannie Mae forecasts for 2024/2025 remain aligned as both lowered 1st mortgage origination estimates ~1.0% for 2024 and raised them 1-2% for 2025 compared to the projections published in June 2024. MBA origination volume is projected at 5.5% higher for 2024 and the same in 2025.

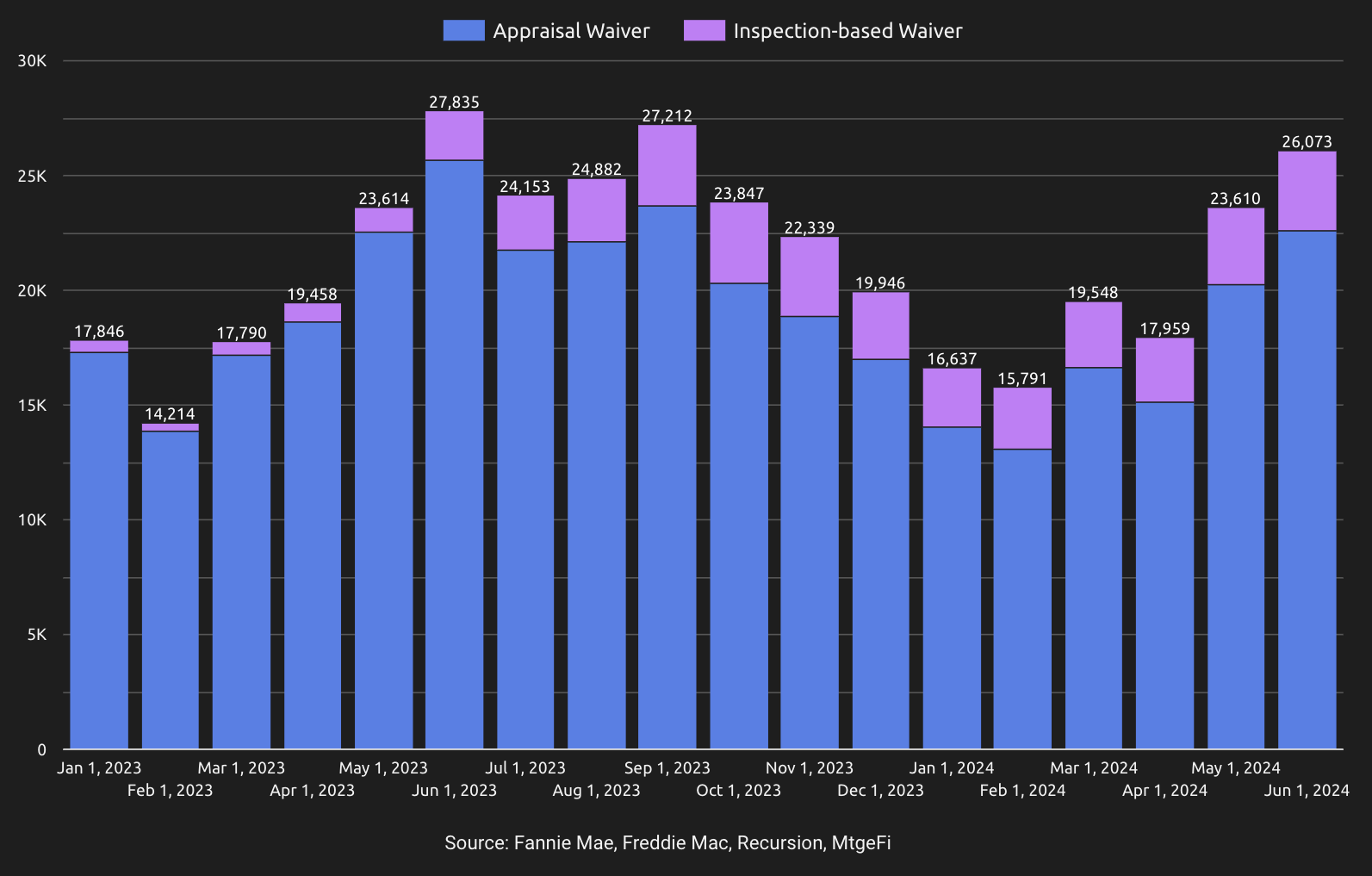

Inspection based waivers and the top 10 reasons to adopt now

Lenders, loan officers and mortgage brokers can take advantage of inspection based waivers and help their borrowers to benefit from these new GSE solutions, stay competitive and reduce their own repurchase risk.

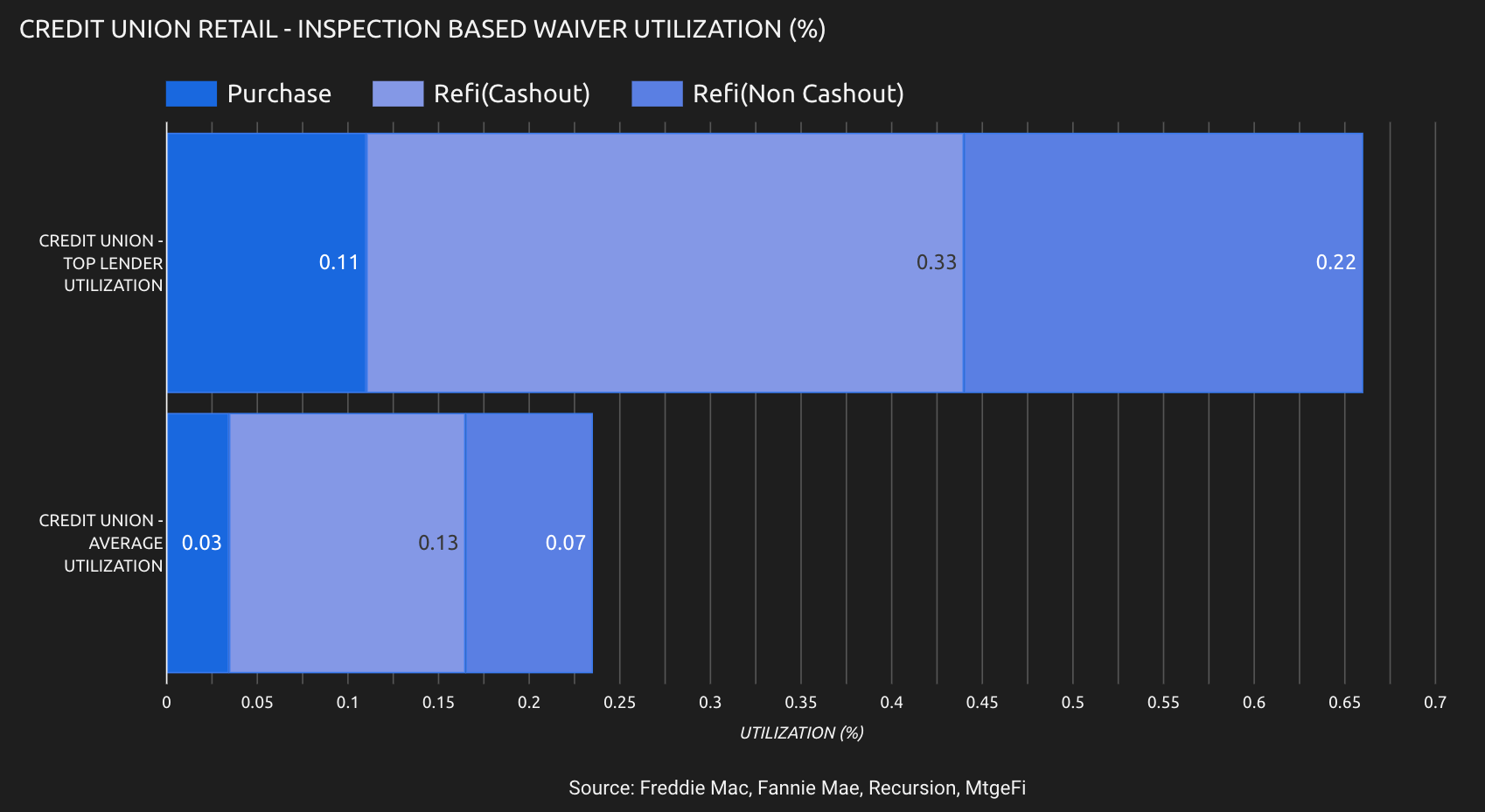

Limited use of inspection based waivers at credit unions an opportunity

Top performing credit unions utilization of inspection based waivers, at 20%, is many times the average credit union. Some lenders like The Golden 1 CU, ENT CU and MidFlorida CU appeared to optimize their use of appraisal and inspection based waivers.

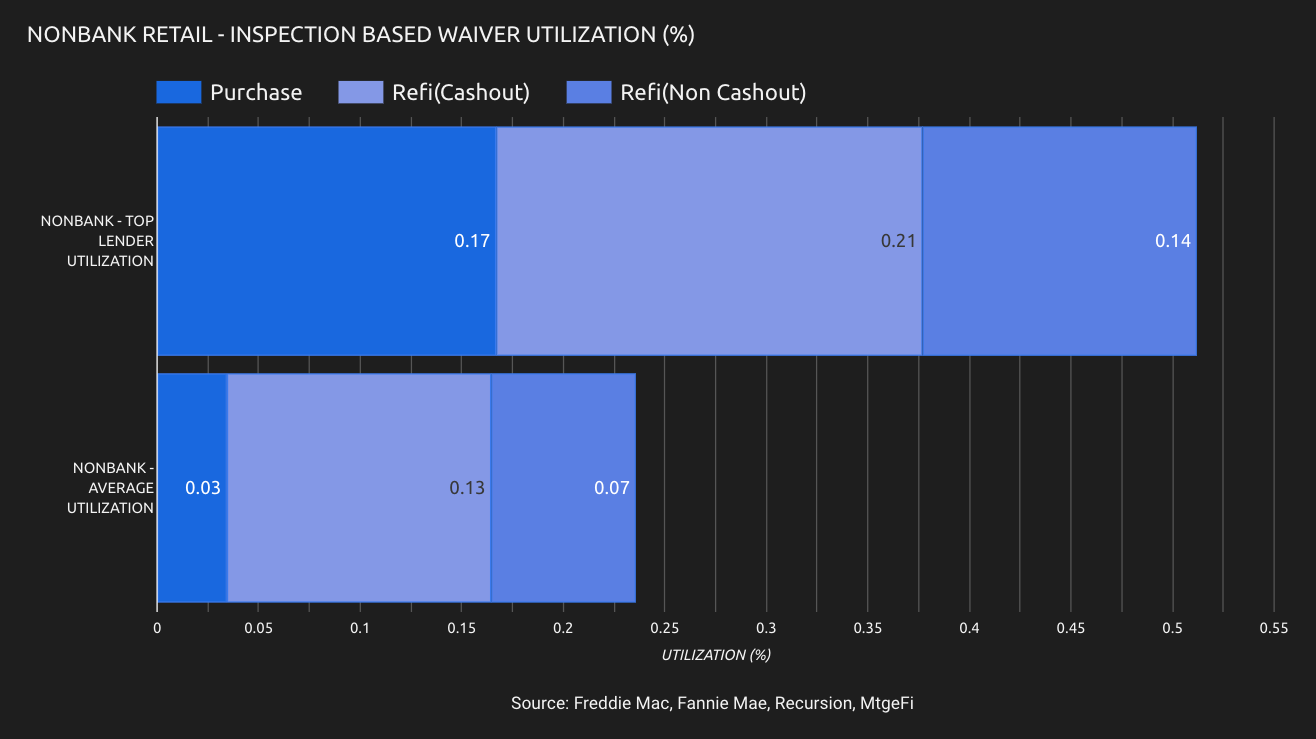

Inspection based waivers at nonbank retail set new benchmarks

For nonbank retail lenders who delivered a minimum of 100 loans in the quarter, top performing lenders utilization is significantly higher. Most notably, with an average of 19% utilization for purchase and refinance, use of inspection based waivers is over 300% when compared to the average lender.