Your cart is currently empty!

MtgeFi Blog

Correspondents make the most of inspection based waivers in September

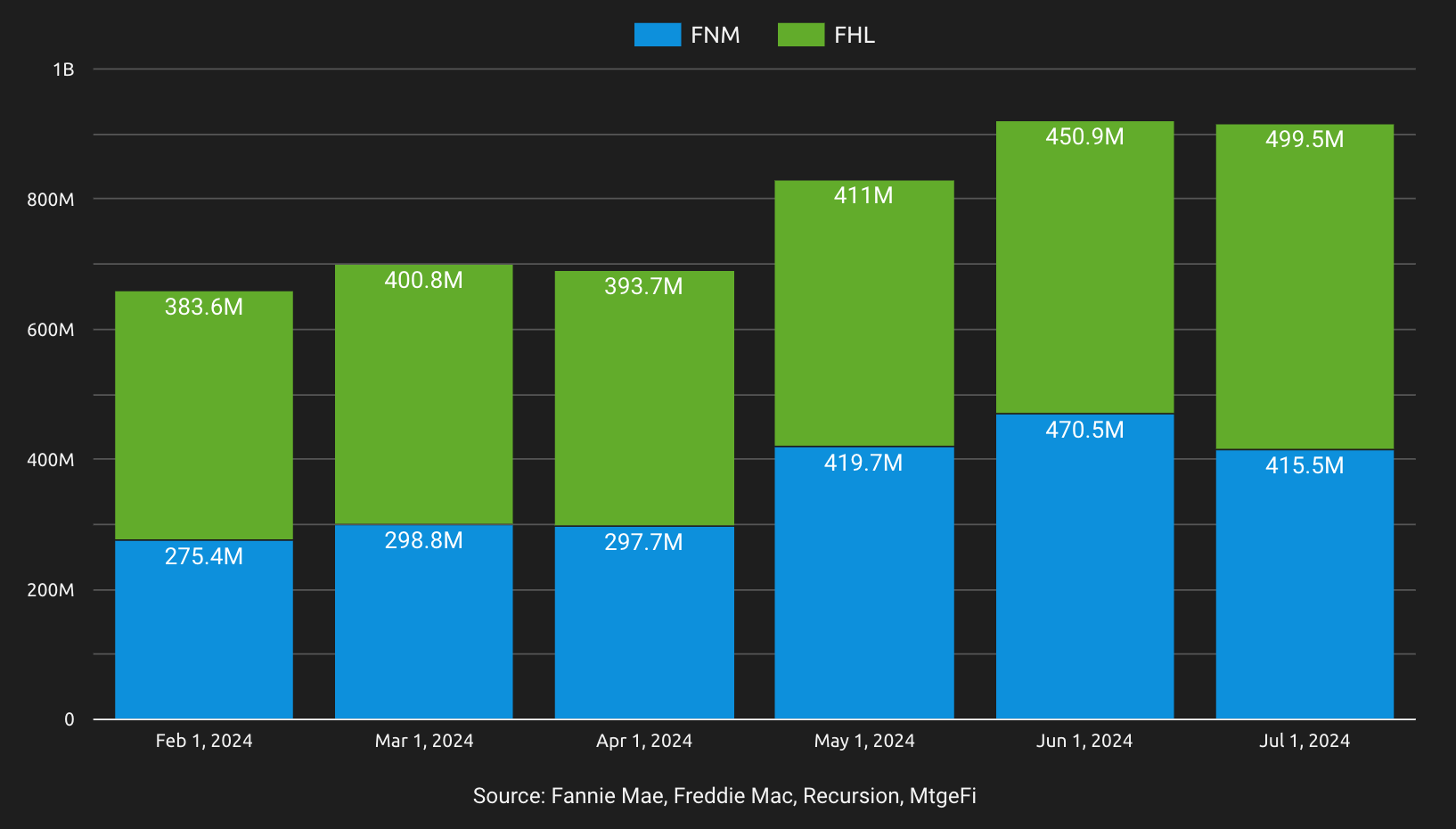

In a month where GSE issuance was down across-the-board, it is noteworthy that the correspondent channel delivered their largest single month of inspection based waivers since both GSE solutions became fully operational, with 19.1% of total issuance.

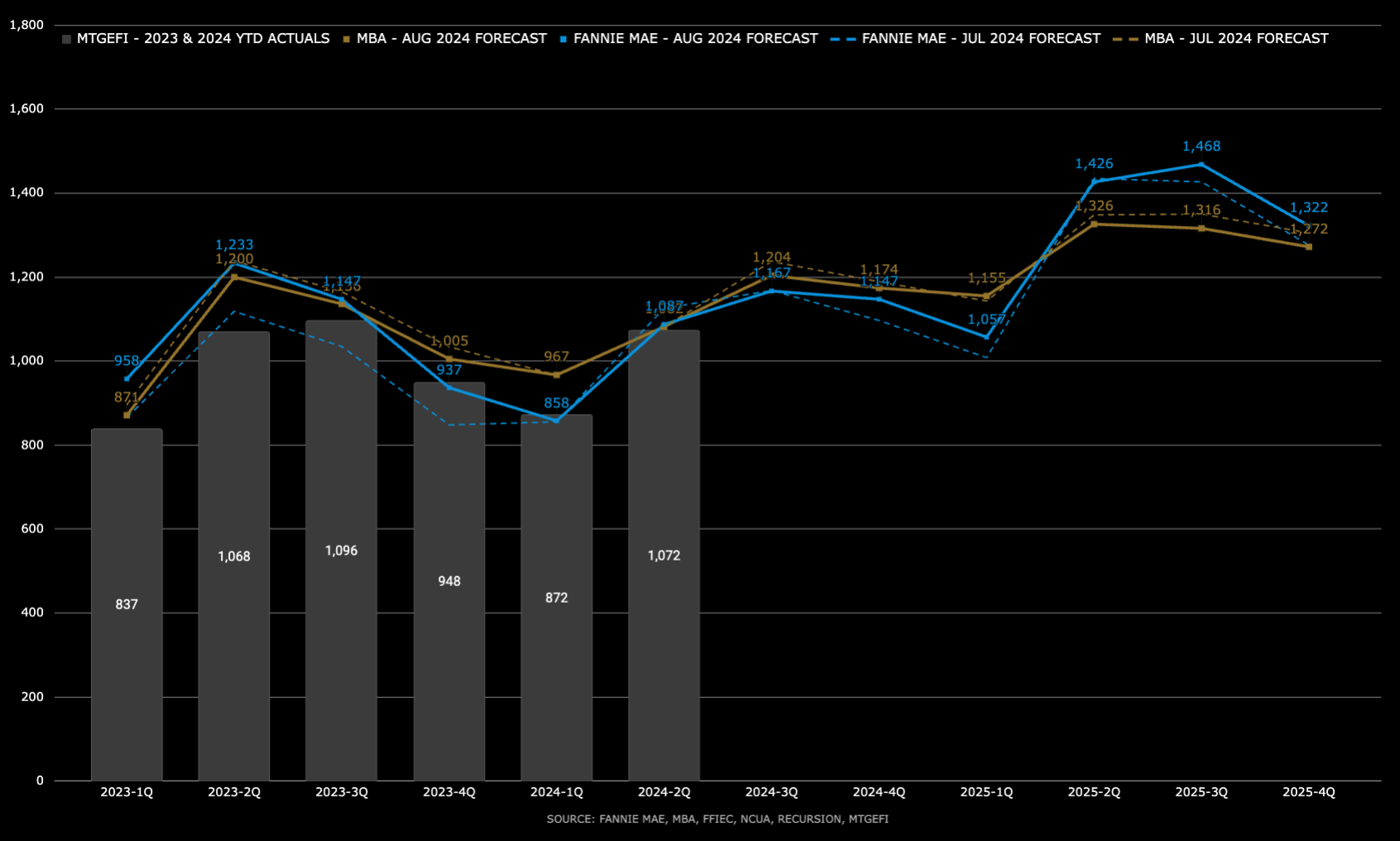

Housing Finance Forecast for September available now for 2024/2025

Fannie Mae and MBA published their latest housing finance forecast for September 2024 this week providing estimates of the quarterly purchase and refinance origination volumes for 1st lien, closed-end, single family mortgages in 2024 and 2025. MBA is now forecasting the number of loan originations to be 8.9% and 10.9% higher than Fannie Mae for…

Appraisal Waivers in August Highest on Rocket Mortgage Utilization

Lenders delivered $915MM (1.56%) with inspection based waivers in July, down 2.3% on June 2024. A total of 1064 correspondents (excludes GSE sellers) have now exercised offers, compared to 547 direct GSE sellers.

Housing Finance Forecast for August available now for 2024/2025

Fannie Mae and MBA published their latest housing finance forecast for August 2024 this week providing estimates of the quarterly purchase and refinance origination volumes for 1st lien, closed-end, single family mortgages in 2024 and 2025. For August, the MBA and Fannie Mae forecasts for 2024/2025 aligned within 5% for both years. MBA lowered 1st…

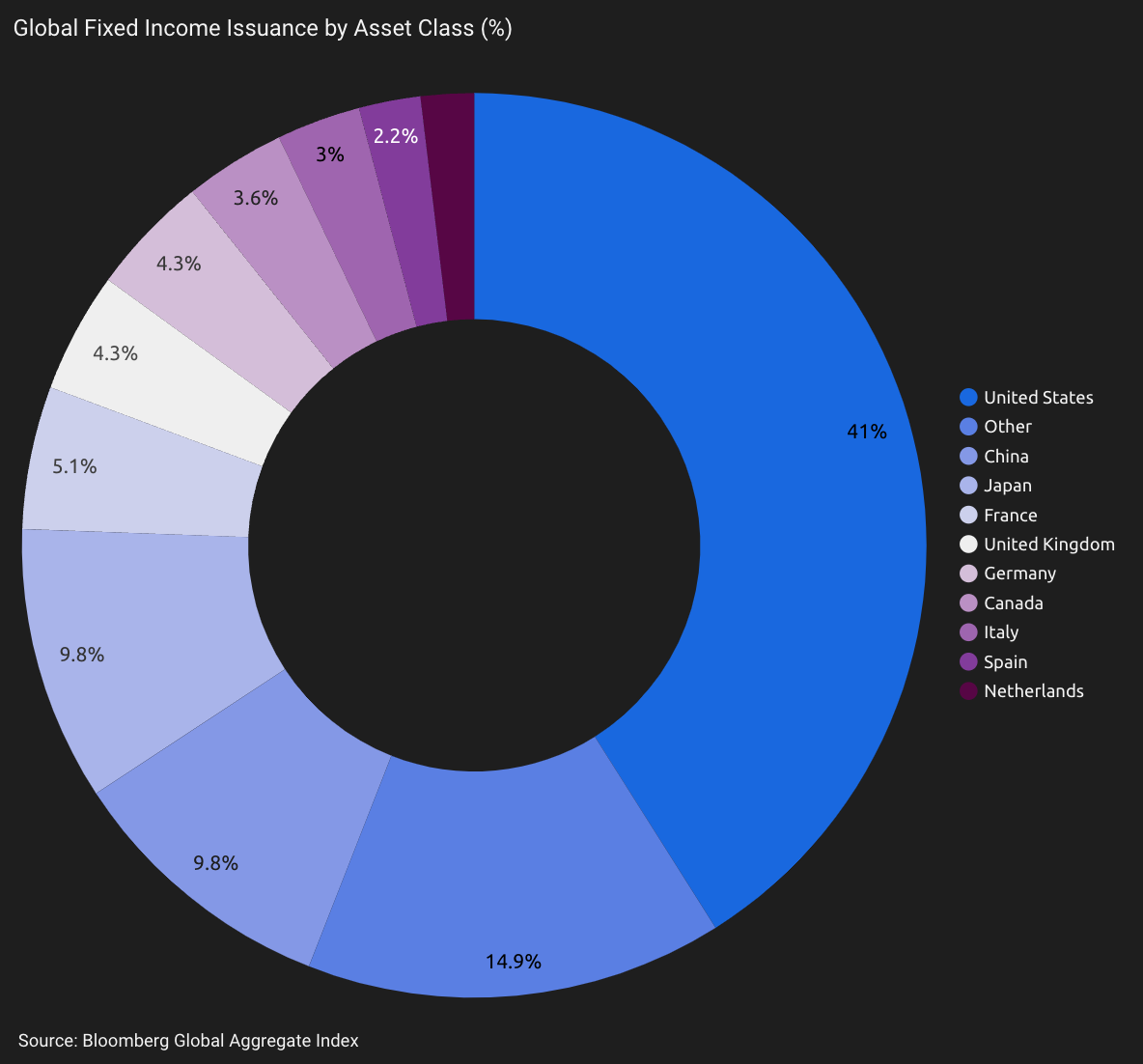

Top 10 reasons appraisals are here to stay, and critical to US and global markets

This article discusses the critical role of residential appraisals & appraisers in US housing finance and the global fixed income securities markets, and highlights the contributions appraisers make, and why they can be confident about the future of their profession.

More than 1,000 correspondents now using inspection based waivers in July

Lenders delivered $915MM (1.56%) with inspection based waivers in July, down 2.3% on June 2024. A total of 1064 correspondents (excludes GSE sellers) have now exercised offers, compared to 547 direct GSE sellers.