Your cart is currently empty!

Since starting the articles on inspection-based waivers, we have had numerous requests for up-to-date market share information on agency loans, waivers and appraisal volumes – this is the first month reporting on total loans – appraisal & waiver volumes will follow shortly. For further requests or clarifications, please contact us directly.

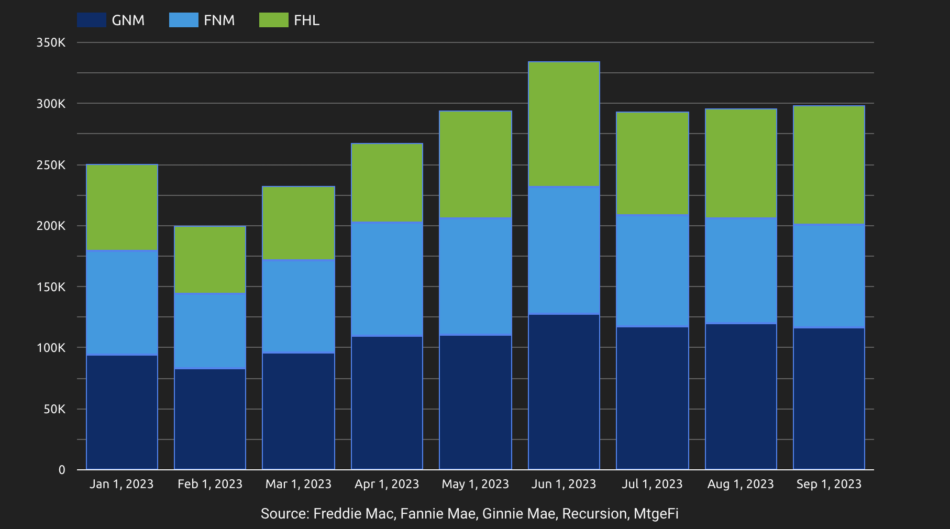

Agency loans

In September, the total number of agency loans delivered was 298,548. The breakdown of total agency loans and market share are Freddie Mac 97,424 (32.6%), Fannie Mae 84,454 (28.3%) and Ginnie Mae 116,570 (39.1%). This was marginally higher (~1%) than the prior month of August, and the second largest monthly delivery after June. Based on loans delivered as-of October 15, loans for the full month of October are expected to be 2-3% higher at 305,000.

Ginnie Mae

For the Ginnie Mae pools, the breakdown was FHA 77,443 (66.4% of Ginnie Mae and 26.0% of total loans), VA 35,234 (30.2% of Ginnie Mae and 11.8% of total loans), RHS 3,785 (3.3% of Ginnie Mae and 1.3% of total loans) and PIH 108 (0.10% of Ginnie Mae and 0.04% of total loans).

Production of agency loans

Retail channels delivered 159,730 agency loans (53.5%), wholesale channels 40,018 loans (13.4%) and correspondent sellers 98,800 loans (33.1%). Ginnie Mae led market share in wholesale at 41.7% and correspondent at 47.8%. Fannie Mae led retail at 35.2%. The majority of FHA and VA loans were originated in retail channels at 45.2%, with correspondent and wholesale channels at 40.3% and 14.5% respectively.

Loan purpose

Purchase money volume was marginally lower than August at 235,464 agency loans (78.9%) with Freddie Mac at 82,928 loans (35.2%), Fannie Mae at 69,370 loans (29.5%) and Ginnie Mae totals at 83,166 (35.3%). Total cash-out refinances were 44,218 (14.8%), up 14.1% over August. Non cash-out refinances were 9,206 (3.1%) up 3.2% from August. Ginnie Mae re-performing loans fell 9.3% to 9,660, and look to be lower again for the full-month of October.

Financial institution

Total agency loans by institution type were 224,546 (75.2%) for non-banks, 60,902 (20.4%) for banks and 13,100 (4.4%) for credit unions and others. The non-banks continue to dominate originations, but bank market share shows some signs of growth, up 8.6% for retail in August.

More about inspection-based waivers

For lenders who wish to learn more about inspection-based waivers for agency loans, you can check out the the following articles. These include links to the Freddie Mac and Fannie Mae collateral valuation modernization strategies, new programs, selling guide updates, FAQs, process flow, job aids, approved technology and service providers, and information about the property data standards and user guides:

- Implementing the Freddie Mac Appraisal Waivers – Quick Reference for Lenders

- Implementing the Fannie Mae Appraisal Waivers – Quick Reference for Lenders

In addition, you can access the Freddie Mac ACE+ PDR Solution page and the Fannie Mae Value Acceptance + Property Data FAQ.