Your cart is currently empty!

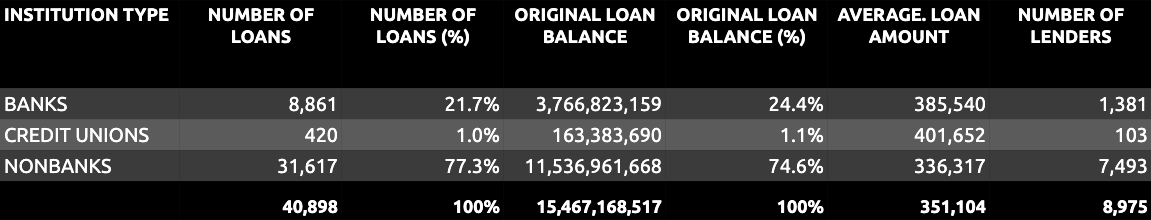

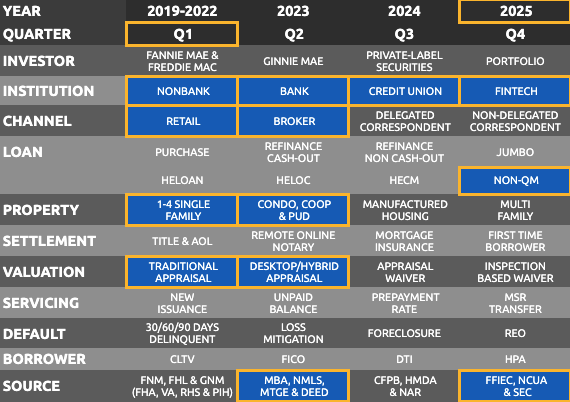

The US single family residential Total Addressable Market (TAM) for Non-QM construction loans in Q1 2025, stands at $15.5BN and 40,898 loans. The average loan size is $351,103 and total number of lenders is 8,975.

Real Estate Investor – Short-Term Construction Loans

Short-term single family building and construction loans for real estate investors are typically available from private hard money, speciality bank and credit union lenders.

These are short-term interest-only loans with the full amount of principal (balloon payment) due at maturity. The repayment of the loan is mainly based on the ability to sell the related mortgaged property or to convert it into a rental property.

The table shows single family residential (1-4 units) loans of 36 months term, or less, and $3 million original balance, or lower. This shows all current loans as-of Q1 2025.

Short term construction loans often require several property inspections and valuations, including traditional or hybrid appraisals, construction draw inspections and final completion reports.

Automated Valuation Models (AVMs) and Broker Price Opinions (BPOs) may also be used for underwriting and servicing depending on the status of the loan.

Marketing of properties, for sale or rental, often require high-definition photography, 3D virtual tours, floor plans and explanation of property characteristics, condition and measurements.

Top 500 Non-QM Single Family Construction Lenders

The Top 500 Non-QM Single Family Residential Building and Construction Lenders in Q1 2025, including Total Loans, Original Balance and Average Loan Size.

Non-QM Construction Loans – RMBS RTL issuance

Non-QM construction loans were traditionally offered by banks, and some credit unions, and retained in their portfolios. In recent years, non-bank Non-QM lenders have dominated originations, and Residential Transition Loans (RTLs) rated securitizations are growing.

RTLs include fix-and-flip mortgage loans, short-term bridge, construction, or renovation loans designed to help real estate investors purchase and renovate residential or small balance commercial properties, generally within 12 to 36 months.

For more information Morningstar DBRS publishes a Residential Transition Loans Primer.

Not seeing what you need? Have questions?

Request more information or a specific report from MtgeFi.com

GSE Construction to Permanent Loans

The GSEs offer construction-to-permanent loan programs, that offer a construction phase up-to 18 months, followed by permanent long-term loan.