Your cart is currently empty!

Inspection based waivers and appraisal waivers save borrowers money, reduce loan origination cycle times, and lower credit risk for the Government Sponsored Enterprises (GSEs). After a few years operating as limited GSE pilots these new solutions are available as Freddie Mac’s ACE+ PDR (automated collateral evaluation plus property data report) and Fannie Mae’s Value Acceptance + Property Data.

This article is intended to help lenders, loan officers and mortgage brokers understand how they can take advantage of these GSE inspection-based appraisal waivers to stay competitive, reduce repurchase risk, and deliver benefits to borrowers.

1. Fast, and predictable

When lenders elect to use an inspection based waiver, they can inform borrowers that a full appraisal is not needed.

ACE+ PDR and Value Acceptance + Property Data is not a valuation and does not require an appraiser to complete the property data report; instead, the property data report may be completed by a background-checked and trained real-estate professional. The most common delay for property inspections is contacting the property owner and scheduling an appropriate time to visit.

Inspectors are typically real estate agents, home inspectors, insurance inspectors, notaries and appraiser trainees. For context there are over 1.5 million real estate agents nationally, so most vendors maintain inspection networks that can complete a property inspection anywhere in the US in a few days. By comparison, the national registry of appraisers includes fewer than 100,000 appraisers.

2. Less expensive, national fees and no cures

The defined scope of inspection based waivers and the enabling technology and inspection networks available have allowed vendors to offer very competitive terms, with fee escalations only in unusual circumstances.

Data indicates that some vendors offer a single nationwide fee from $225 – $275 depending on order volume, and the products are available for ordering via most Appraisal Management Companies (AMCs) and Appraisal Management Software (AMS) platforms.

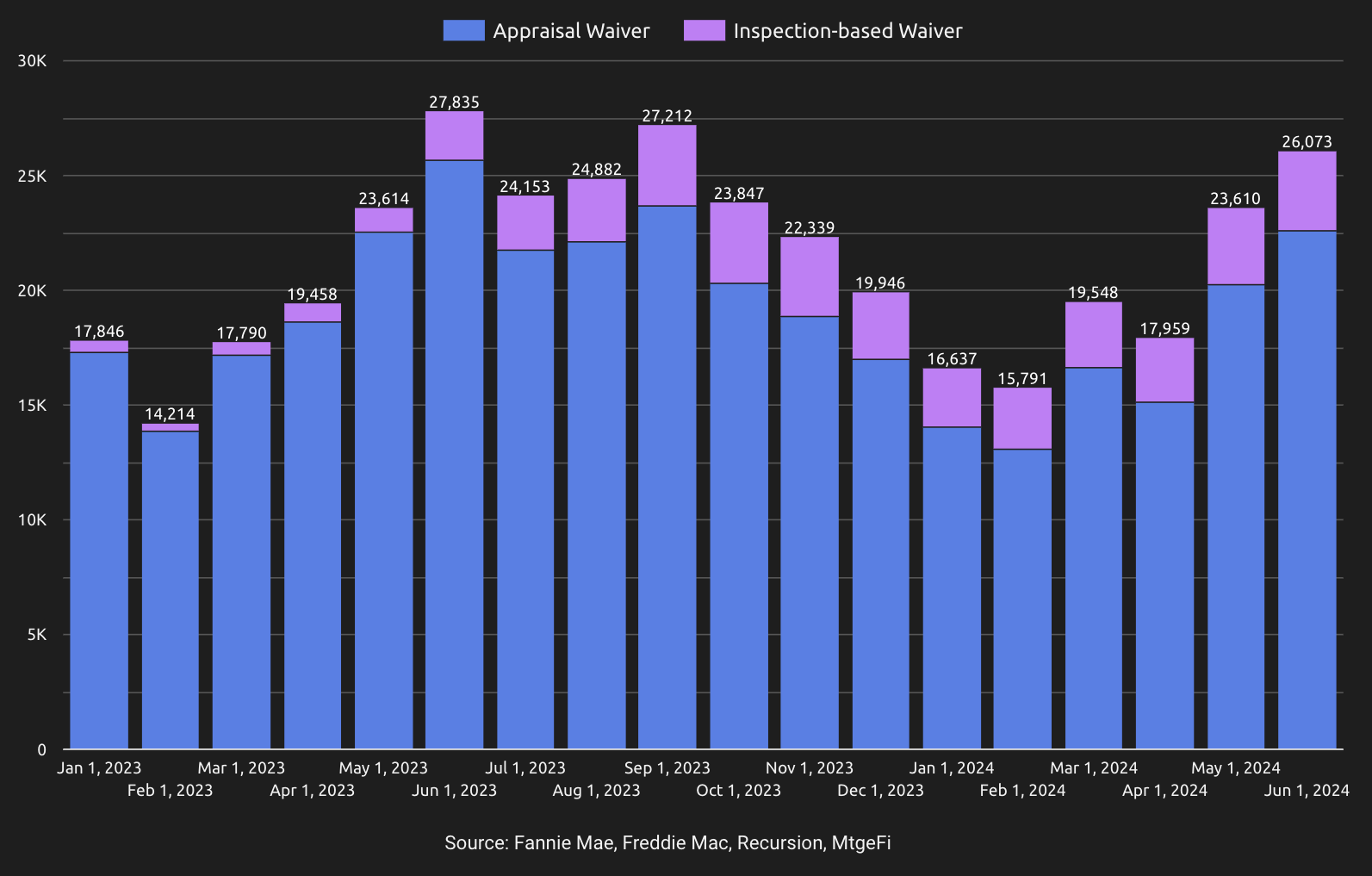

3. Top lender utilization is ~500% industry average

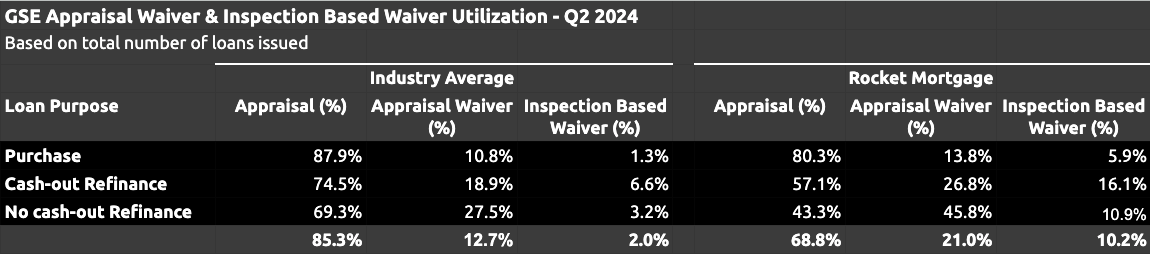

A comparison of industry-average usage rates of inspection-based appraisal waivers illustrates the opportunity most lenders have to increase adoption of these solutions, improve the competitiveness of their sales teams and pass along the benefits to borrowers.

The table shows purchase, cash-out refinance and no cash-out refinance rates based on all GSE loans delivered in Q2 2024.

4. Broad eligibility, for purchase and refinance

The GSEs publish broad eligibility criteria for inspection-based appraisal waivers and also list exclusions, which include but are not limited to, criteria based on loan types, property types, occupancy types and loans with certain loan to value ratios.

Each GSE requires the use of their respective automated underwriting system, Freddie Mac’s Loan Product Advisor® (LPASM) and Fannie Mae’s Desktop Underwriter (DU), to determine eligibility for an inspection-based appraisal waiver. Freddie Mac’s inspection-based appraisal waiver and appraisal waiver eligibility criteria can be found in their Single-Family Seller/Servicer Guide Section 5602.4. Fannie Mae inspection-based appraisal waiver and appraisal waiver eligibility criteria can be found in their Single Family Selling Guide B4-1.4-11, Value Acceptance + Property Data.

5. GSEs have a common property data collection format

Starting April 1, 2024, the GSEs adopted a single Uniform Property Dataset (UPD), for Fannie Mae’s Property Data Collections (PDCs) and Freddie Mac’s Property Data Reports (PDRs) respectively. UPD consists of all required, conditionally required and optional data elements for GSE property data collection and supports a full interior and exterior data collection, with images and floor plan of the subject property.

With one, standardized GSE data set, underwriting property data reports is now easier.

6. Acceptance of property value

Assuming the qualifying loan characteristics are accurate and do not change, acceptance of an inspection-based waiver offer from Freddie Mac and Fannie Mae is final. Occasionally the lender’s review of the property data report may reveal that the property is not eligible for the offering or has characteristics or conditions that require an upgrade to an appraisal, but this occurs infrequently.

Lenders (originators and aggregators) obligations are, as with all loans, to review the property data report and validate the subject property information and characteristics, and confirm the property meets the GSE property and program eligibility requirements.

7. Representation and warranty relief on property value estimate

When a lender accepts inspection-based waivers and completes the applicable PDR, the GSE accepts the value estimate submitted by the lender as the value for the subject property. The value could be the purchase price, an owner-estimated value, or a lender-determined estimate of value.

After submission of a Freddie Mac PDR to the bACE API, LPA will provide collateral representation and warranty relief eligibility messaging. The lender remains responsible for the accuracy and completeness of all data that pertains to the property and must warrant that the property is adequately insured. Similarly, Fannie Mae requires that after the PDC is collected and after passes through lender quality control checks, it must be submitted to their Property Data API.

8. Upgrade to hybrid appraisal in 0.43% of files

We examined two representative proprietary loan-level origination datasets of purchase and refinance transactions closed using appraisals, inspection based waivers and appraisal waivers. Only in a few cases does a PDC or PDR result in an upgrade to an appraisal:

- Upgrade to a hybrid appraisal occurred in 0.43% of files

- Upgrade to a traditional appraisal did not occur on any files in the dataset

PDC/PDRs required a limited number of Property Completion Reports:

- Property Completion Reports were required for 1.92% of PDC/PDRs

- No PDC/PDRs required more than one Property Completion Report

For comparison, in the same datasets an Appraisal Update/Completion (Form 442/1004D) report was required in 13% of cases when a traditional appraisal (Form 70/1004) was completed.

9. Simple Property Completion Report

When a Property Completion Report is required after a property data report, the GSEs permit the Property Data Collector to revisit the property and confirm renovations and repairs were completed as required. The fees are typically $150-$175. Inspection-based appraisal waivers are not available on construction loans or construction-to-permanent loans.

This is similar to the Appraisal Update and/or Completion Report (Form 442/1004D) used to confirm construction, renovations and repairs were performed satisfactorily after a traditional appraisal has been completed. Form 442/1004D fees are typically $175-$200 in addition to the initial cost of the appraisal, and subject to availability of appraisers. The GSEs also allow other alternatives to Form 442/1004D.

10. Fewer repurchases

The loan performance data for 2023 indicates that 0.81% of all Freddie Mac repurchases are on loans with inspection based waivers. For Fannie Mae 0.06% of repurchases were on loans with inspection based waivers.

As before, this data does not specify the reason for the repurchases. Further, Freddie Mac Automated Collateral Evaluation (ACE) and Property Data Report (ACE+ PDR) was introduced on July 17, 2022 and Fannie Mae Value Acceptance and Property Data (VA + PD), was released on April 15, 2023, so there has been limited seasoning.

More information about inspection based waivers and appraisal waiver solutions

To learn more, check out the the following articles. These include links to the Freddie Mac ACE+ PDR and Fannie Mae Valuation Acceptance + Property Data, as well as collateral valuation modernization strategies, new programs, selling guide updates, FAQs, process flow, job aids, approved technology and service providers, and information about the Uniform Property Dataset (UPD) and user guides:

- Implementing the Freddie Mac Inspection-based Waivers – Quick Reference for Lenders

- Implementing the Fannie Mae Inspection-based Waivers – Quick Reference for Lenders

In addition, you can access the Freddie Mac ACE+ PDR Solution page and the Fannie Mae Value Acceptance + Property Data FAQ.