Your cart is currently empty!

For May 2024, GSE issuance totaled $54.5BN, up 33.0% on April. For property valuations, $47.7BN (87.7%) closed using appraisals, up 33.7%, and $6.06BN (11.1%) closed utilizing appraisal waivers, up 29.6% on the prior month. Lenders delivered $831MM (1.52%) with inspection-based waivers, up 20.1% on April 2024 and the highest for 6 months.

Overall, inspection-based waivers were 14.0% of the combined appraisal waiver (non-appraisal) solutions by loan balance. By number of loans delivered, inspection-based waivers were 18.2% of all waiver solutions, up 2.1% from the prior month.

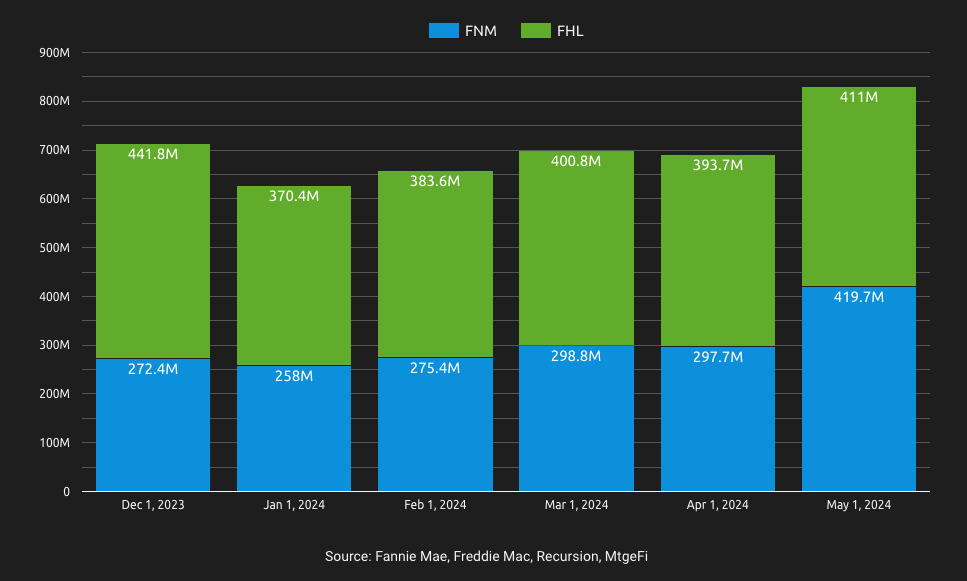

Agency share of inspection based waivers in May

Fannie Mae Valuation Acceptance + Property Data market share of inspection-based waivers increased to 50.5% and $420MM, a jump of 41.7% in May and the highest issuance since October 2023. There are now 382 lenders who have delivered loans through Fannie Mae Valuation Acceptance + Property Data, including 203 independent mortgage companies and 109 banks and 70 credit unions, remained the same as the prior month. For May, a total of 64 lenders issued loans using inspection-based waivers, an increase of 73% from April.

Freddie Mac ACE+ PDR (Automated Collateral Evaluation plus Property Data Report) market share fell back to 49.5% on increased volume at $411MM. Freddie Mac participation increased slightly to 355 lenders, including 140 community banks, 27 credit unions, and 190 non-banks. For May, a total of 156 lenders issued loans using inspection-based waivers.

Production channel and key lenders

Broker channel issuance was $9.37BN in May with 111 lenders delivering loans. The correspondent channel issuance was $17.5BN from 167 lenders and retail issuance was $27.6BN from 1,182 lenders.

For inspection-based waivers, mortgage brokers volume increased by 29.7% to $238M and 28.6% of loan delivered. Rocket broker share grew 73.8% in a single month to reach 48.1%, with UWM at 39.7%. NewRez, First Community Mtge, Plaza Home Mtge and CMG Mtge made triple-digit gains from smaller baselines in April.

The correspondent channel was up to $118M and 14.2% of overall volume. PennyMac and UWM lead with 23% market each, with Truist, Flagstar Bank and US Bank also making triple-digit gains from April.

Retail channel utilization of inspection-based waivers in May increased 16.1% to $474M and 57.1% of issuance. Notable increases came from Prime Lending, Prosperity Home Mtge and American Pacific Mtge.

Top Mortgage Originators by Agency Property Valuations for Q1 2024

The product provides top agency mortgage originators for Q1 2024 by loan volume, including institution type, agency, channel, loan purpose and property valuations (including appraisal, appraisal waiver and inspection-based waiver loan counts be lender), and is in an easy-to-use format for analysis and loading into financial, sales and marketing systems.

More information about inspection-based waivers

For lenders who wish to learn more, you can check out the the following articles. These include links to the Freddie Mac ACE+ PDR and Fannie Mae Valuation Acceptance and collateral valuation modernization strategies, new programs, selling guide updates, FAQs, process flow, job aids, approved technology and service providers, and information about the property data standards and user guides:

- Implementing the Freddie Mac Inspection-based Waivers – Quick Reference for Lenders

- Implementing the Fannie Mae Inspection-based Waivers – Quick Reference for Lenders

In addition, you can access the Freddie Mac ACE+ PDR Solution page and the Fannie Mae Value Acceptance + Property Data FAQ.