Your cart is currently empty!

This article reviews adoption of GSE appraisal alternatives in 2023 by banks who originate & aggregated loans directly for their balance sheet, and for issuance with the agencies. This is for 1st lien closed-end 1-4 family residential mortgages.

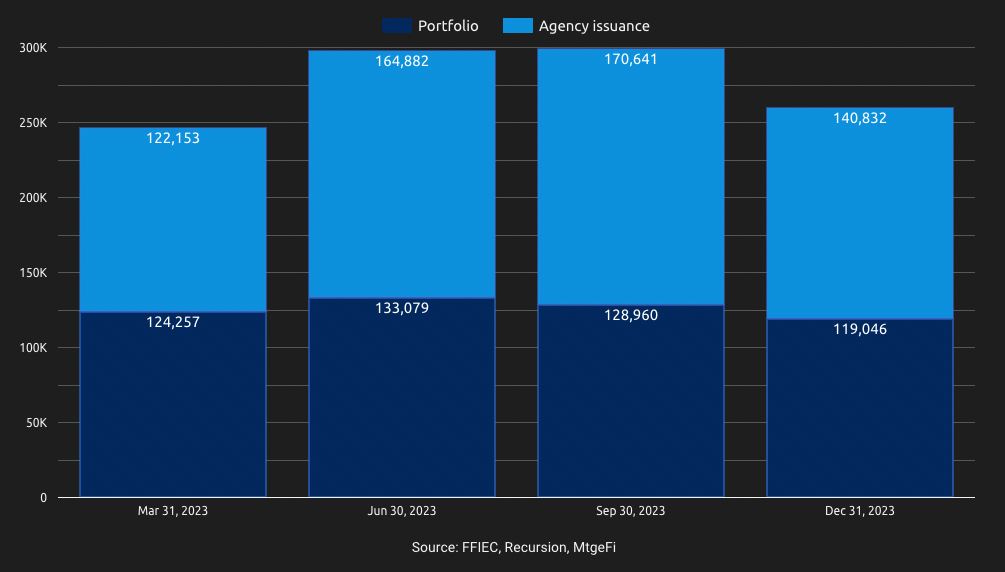

Bank agency and portfolio lending

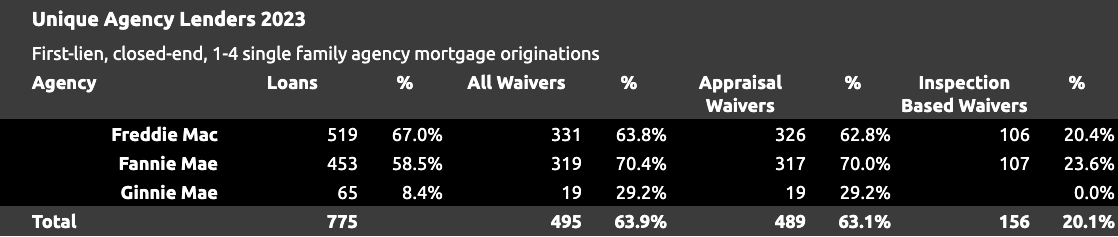

For the full year there were 775 banks delivering to the agencies out of a total of 1,730 total issuers, with 519 (67%) delivering to Freddie Mac, 453 (58.5%) delivering to Fannie Mae and 65 (8.4%) delivering to Ginnie Mae. Total agency issuance volume for banks was 598,508 loans.

In 2023 there were ~2,000 banks that originated or aggregated loans ‘held for investment’, with 75% of volume concentrated in the top 200 banks. The majority of these banks are also agency issuers. As of Q4 2023 there are 4,083 banks holding first lien closed-end 1-4 units residential mortgages on their balance sheet, representing 82% of 4,936 active banks. Total held for investment loans originated and purchased during the year was 505,145 loans.

GSE appraisal alternatives

Of the 775 bank sellers, 772 (99.6%) utilized appraisals, 489 (63.1%) utilized appraisal waivers and 156 (20.1%) utilized inspection-based waivers when delivering loans.

Freddie Mac had 15% more direct bank sellers (519) than Fannie Mae (453) in 2023, and more banks using their waiver solutions (331) than Fannie Mae (319). However the overall percentage of banks was lower at 63.4% compared to 70.4% for Fannie Mae.

Top Bank Portfolio & Agency Lenders with Property Valuations in Q4 2023

The top bank mortgage originators by agency and portfolio loan volume, with agency property valuations, for Q4 2023, in an easy-to-use format for analysis and loading into financial, sales and marketing systems.

Appraisal waivers

Appraisal waivers were the first GSE appraisal alternatives available and many banks have utilized these several years but saw increased adoption in 2020 as refinance origination volume spiked. In Q1 2020 appraisal waivers were utilized on 15.5% of loans, but 12 months later in Q1 2021 utilization reached 39.3% on agency issuance.

The catalyst for some larger banks to start using appraisal waivers was COVID-19, and once approved by credit committees this use has been maintained and expanded.

In January 2024, banks used appraisal waivers on 8.7% of all loans delivered to the agencies (including Ginnie Mae streamline refinances), higher than both credit unions and nonbanks at 7.8% and 6.45% respectively.

Inspection-based waivers

The adoption of inspection-based waivers by banks steadily increased throughout 2023, from 15 banks at the end of Q1 2023 to 156 at year-end. Early indications in Q1 are that additional banks are introducing inspection-based waivers, and we expect this to effectively double to 320 participants throughout 2024, achieving the same levels as appraisal waivers. This article provides an update on inspection-based waivers for February 2024.

Conclusions for non-agency & portfolio lending

The streamlining of the inspection-based waiver ordering process, unification of the GSE Uniform Property Dataset (UPD) and GSE analysis showing that loans originated with inspection-based waivers have the same or better credit risk characteristics over traditional appraisals (due to the credit box) should further accelerate adoption.

The additional benefits of appraiser independence, mitigation of racial and purchase contact confirmation bias, coupled with reductions in costs and turnaround time for the borrower – now routinely $250 and 3-4 days or less – make inspection-based waivers, if the loan is eligible via an AUS, the next best alternative to an appraisal waiver.

Further, banks have approved and utilized alternative proprietary valuations in their consumer and home equity lending programs from many years, including interior and exterior inspections, automated valuation models (AVMs), desktop and hybrid appraisals.

The GSE appraisal alternatives formalize valuation standards that will over time be accepted by all industry stakeholders – including ratings agencies, insurers and investors – and be adopted for portfolio and consumer lending, non-QM programs and private label securitization.

More information about GSE appraisal alternatives

For lenders who wish to learn more about GSE appraisal alternatives, you can review the the following articles. In addition, you can access the Freddie Mac ACE+ PDR Solution page and the Fannie Mae Value Acceptance + Property Data FAQ.